Bitcoin Falls Below $100K as Crypto Market Sheds $554 Million in Liquidations – Markets and Prices Bitcoin News

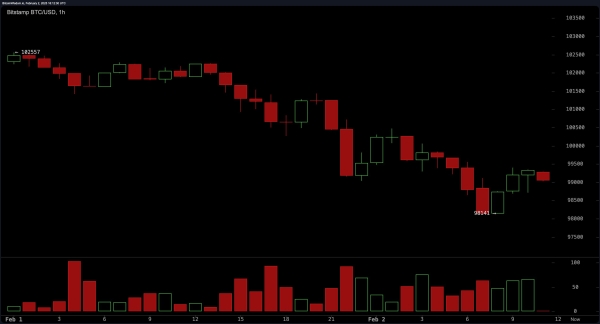

On Sunday, Feb. 2, 2025, the price of bitcoin fell below the $100,000 mark, reaching an intraday low of $98,141.

Selling Pressure Sends Bitcoin Below $100K

It is not an ideal day for the world’s leading crypto asset, which has declined about 3% against the U.S. dollar over the past day. The 24-hour intraday high hit $102,261 per bitcoin, yet around 8 a.m. ET on Sunday, it reached a low of $98,141.

Trading volume experienced a modest increase on Sunday, though much of this rise came from selling pressure. At present, bitcoin (BTC) is drifting just above the $99,000 level after slipping below that threshold.

The downturn has led to $554.82 million in liquidations throughout the crypto economy, according to coinglass.com stats. Approximately $95.66 million of those positions were bitcoin (BTC) long bets.

In total, $483.09 million of the day’s positions were all long wagers. A sum of 242,789 traders saw their positions wiped out, with the largest liquidation occurring on Binance when an ethereum trader lost $11.84 million.

The latest dip has dispelled the hype surrounding Trump’s efforts to alter the crypto market in the United States. Bitcoin’s stumble below $100,000 demonstrates the vulnerability of even the most established crypto assets amid shifting sentiment. The increase in liquidations, led by overleveraged long positions, reveals a market wrestling with speculative excess.

While political narratives like Trump’s regulatory push may briefly buoy optimism, this downturn illustrates that macroeconomic tremors and trader psychology remain decisive—forces no policy or hype can fully tame. By 11:15 a.m. ET, BTC had retreated below the $99,000 range.