Head of Fundstrat Research Calls Monday’s Sell-Off an ‘Overreaction’ and a Great Buying Opportunity

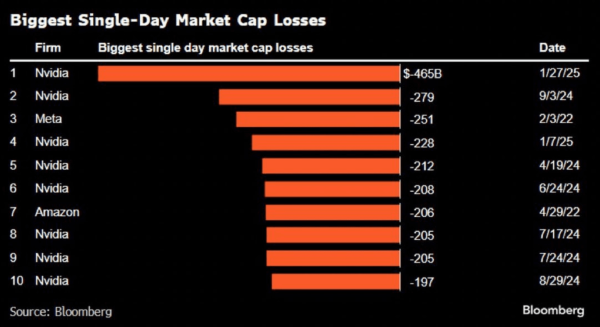

On Monday, NVIDIA had the largest single-day market cap loss in history, erasing $465 billion in market cap.

Updated Jan 28, 2025, 12:21 p.m. UTCPublished Jan 28, 2025, 10:56 a.m. UTC

What to know:

- Tom Lee, head of Fundstrat Research, called Monday's price action an overeaction.

- U.S. markets look healthy as bitcoin outperforms small caps and financials year-to-date.

Tom Lee, head of Fundstrat Research, discussed Monday's market sell-off as an "overreaction". On CNBC, Lee said that the double-digit drawdown in NVIDIA (NVDA) is the biggest opportunity since the covid outbreak and will prove to be a great buying moment.

"Markets don't like uncertainty, to me, it's an overreaction, and this overreaction will be a great opportunity for investors," Lee said.

Lee's call seems good so far. After Nasdaq sold off 3% and NVIDIA dropped 17%, ,Nasdaq futures are up 1% while NVDA is 5% higher in pre-market trading.

Monday's sell-off in NVDA was the biggest single-day market cap loss in history, with NVIDIA losing $465 billion in market cap, according to Bloomberg Data.

Bitcoin (BTC) fell as far as $97,500 on Monday and is already back above $103,000; but was as high as $105,000 before the news came out on the AI China's DeepSeek; this will be a level bulls will look to reclaim in the short-term.

AI bitcoin miners also saw massive drawdowns, as much as 30%, including Core Scientific (CORZ), which is now slightly higher in pre-market.

Lee also alludes to a healthy market structure in U.S. equities and notes that bitcoin has outperformed small caps and financials year to date.

Wednesday turns to a Federal Reserve policy meeting which is largely expected for the federal funds rate to be paused at the 4:25-4:50 rate. Lee says there is some uncertainty going into the meeting as markets are currently too hawkish and believe the market is putting too much emphasis on a potential rate hike in 2025.