Bitcoin’s Sharp Descent Sparks $132M in Liquidations Amid Market Volatility – Markets and Prices Bitcoin News

On Sunday, bitcoin’s price slid to an intraday low of $101,957 after reaching an earlier high of $105,424. This downturn set off the liquidation of more than $128 million in bitcoin long positions across crypto derivatives markets within a four-hour window.

Bitcoin Plummets from $105K High

As of 8 p.m. ET, the cryptocurrency market maintains a valuation of $3.5 trillion, despite a 2.56% decline over the last 24 hours. Bitcoin, which had spent much of the day trading steadily between $104,800 and $105,400, began losing ground at 2 p.m. ET.

The leading cryptocurrency now holds a market capitalization of $2.04 trillion, reflecting a 1.7% decrease against the U.S. dollar, with individual coins trading at $102,052. In the past 24 hours, bitcoin recorded a global trading volume of $21.80 billion, with late-afternoon selling pressure fueling a moderate increase in activity.

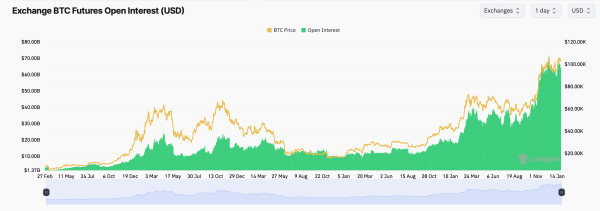

Total liquidations across crypto derivatives markets reached $371.94 million during this time frame, including $132 million in bitcoin long positions, $128 million of which occurred in just four hours. Despite the sell-offs, open interest in bitcoin futures markets remains high, exceeding $64 billion.

Within the crypto economy’s overall trading volume of $83.94 billion, tether (USDT) dominated with $67 billion, reaffirming its status as the day’s most-traded token. Bitcoin currently commands 57.9% of the crypto market’s aggregate value, while ethereum accounts for 11.1% as of Sunday.

The Crypto Fear and Greed Index, published by Alternative.me, stands at 71, signaling a prevailing sentiment of “greed.” Recent fluctuations in bitcoin’s price highlight the ongoing tug-of-war between bullish optimism and market uncertainty as January nears a close.

While long liquidations and selling pressure highlight investor caution, the sustained high trading volumes and open interest suggest confidence remains a significant force.