Why is Crypto Down Today? 3 Key Reasons Why

The crypto market is down today after the US Federal Reserve Chair Jerome Powell shared more hawkish remarks than expected.

The Fed announced a 25-basis-point rate cut, and it signaled fewer rate reductions in 2025 than projected.

Commenting on Strategic Bitcoin Reserve speculations, Powell said that “we’re not allowed to own Bitcoin.” He added that any potential reserve would require Congressional consideration.

Meanwhile, Binance.US said it plans to restore USD services by early 2025, which would be beneficial for digital assets in the US and, likely, the overall market.

At the time of writing, the global cryptocurrency market capitalization is down 4.7% over the last 24 hours, moving further away from the $4 trillion mark. It now stands at $3.68 trillion.

The daily crypto trading volume is $333 billion, somewhat higher than what we’ve been seeing over the last few days, but lower than the numbers seen at the start of the rally.

Only 5 of the top 100 coins per market cap have seen their prices rise today, while the rest dropped.

Top 10 Coins Are Down 4.7% On Average Today

All top 10 coins per market cap have seen their price decrease today.

The largest drop is Dogecoin (DOGE)’s 6.9% to $0.35936.

It’s followed by XRP (XRP) and Cardano (ADA): 6.3% each. XRP currently trades at $2.36, and ADA fell below $1, standing at $0.96904.

The rest of the list is down between 2% and 5%.

Bitcoin (BTC) decreased by 2.3%, currently trading at the price of $101,688.

At the same time, Ethereum (ETH) decreased by 5%, changing hands at $3,670.

Meanwhile, Bitcoin and Ethereum spot exchange-traded funds (ETFs) recorded inflows for two straight weeks, reflecting strong investor interest.

On Wednesday, Bitcoin spot ETFs saw a total net inflow of $275 million, and Ethereum spot ETFs reached $2.45 million.

Additionally, Bitcoin mining machines prices surged in Shenzhen, China, following the recent spike in the Bitcoin price.

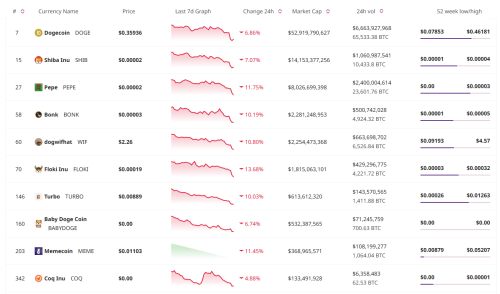

Top 10 Meme Coins Are Down 9.4% On Average Today

The top 10 meme coins have recorded a significant drop today.

Not only are all of them down, but six saw double-digit drops as well.

The highest among these is Floki Inu (FLOKI)’s 13.7%. The coin currently trades at $0.00019.

Next up are Pepe (PEPE) and Memecoin (MEME), with drops of 11.75% and 11.45% to $0.00002 and $0.01103, respectively.

The rest of the list is down between 4% and 11% per coin.

The category’s first coin per market cap, Dogecoin (DOGE), fell 6.9% to $0.35936, while the second coin, Shiba Inu (SHIB), fell 7.1% to the price of $0.00002.

At the same time, while the 2025 outlook for DOGE looks promising, the coin could see further downside in the coming weeks.

Unsurprisingly, the meme coins, too, slumped following the hawkish policy announcement from the US Federal Reserve.

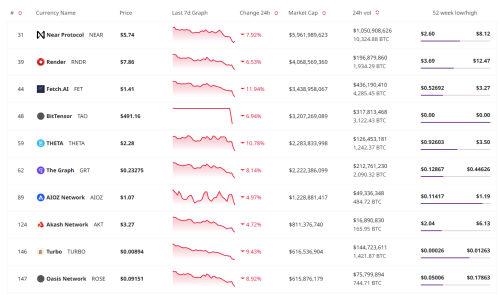

Top 10 AI Coins Are Down 8% On Average Today

Just like the previous two categories, all top 10 AI coins recorded drops in their prices over the past 24 hours.

Two saw double-digit decreases. Fetch.AI (FET) is down nearly 12% to $1.41, while Theta (THETA) fell 10.8% to $2.28.

These are followed by Turbo (TURBO)’s 9.5% drop to the price of $0.00894.

The rest of this list is down between 4% and 9%.

Near Protocol (NEAR), the top coin in this category, fell just below 8%, now trading at $5.74, while the second-placed Render (RNDR) dropped 6.5% to $7.86.

Meanwhile, last Thursday, the Artificial Superintelligence Alliance (ASI) – involving SingularityNET, Fetch.ai, and Ocean Protocol – unveiled its roadmap. It includes plans and goals for 2025.

Additionally, it republished the ASI CORTEX whitepaper yesterday, which it shared in late November. ASI aims to build advanced foundational models across various areas of AI, with an emphasis on robotics, said the team. “Our initial goal is to develop and train Cortex, a model designed to improve robotic capabilities significantly through cutting-edge AI.”

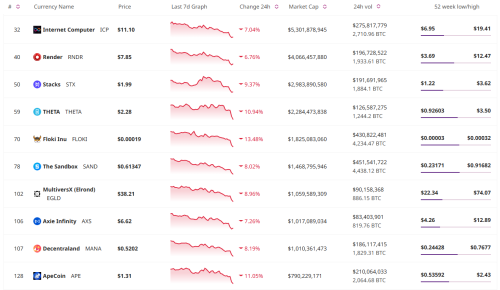

Top 10 Metaverse Coins Are Down 9.1% On Average Today

The all-red trend continues with the top ten metaverse coins.

The highest decrease here is 13.5% recorded by Floki Inu (FLOKI), which is currently trading at $0.00019.

ApeCoin (APE) and Theta (THETA) also saw double-digit falls of around 11% each, now changing hands at $1.31 and $2.28, respectively.

At the same time, the smallest drop in this category is Render (RNDR)’s 6.8% to $7.85.

The top coin in this category, Internet Computer (ICP), is down 7%, with its price now standing at $11.1.

Meanwhile, the FLOKI team recently announced that the Valhalla mainnet launch would be delayed until the first quarter of 2025 in line with feedback from the auditors.

This Tuesday, it shared the eligibility checker for the MONKY launch airdrop. It is available to FLOKI and TOKEN holders. Today, the team said that the Wise Money token is live on Binance Alpha, as a part of the new batch of 10 Binance Alpha Projects.

Top 10 Gambling Coins Are Down 5.3% On Average Today

Unlike other categories in this article, one of the top 10 gambling coins has seen its price increase today.

SX Network (SX) appreciated 1.2% to the price of $0.08446.

On the other hand, one coin recorded a double-digit drop. Dotmoovs (MOOV) is down 13.4% to $0.00188.

It’s followed by REKT (REKT), which fell 9.5%, while the rest of this list is down between Edgeware (EDG)’s 0.9% and FUNToken (FUN)’s 8.6%.

Rollbit Coin (RLB), the category’s top coin, decreased 7.7%, now trading at $0.12368.

Dotmoovs recently partnered with Kutsaca, a Mozambique-based organization empowering vulnerable children through sports, creativity, and education. The team is preparing “a special event” is to celebrate this collaboration, they said.

Read more: What’s Happening In Crypto Today? Daily Crypto News Digest

Key Factors Behind Crypto Market Decrease

Crypto markets can move on a dime, switching from uptrends to sudden drops without warning. Part of the challenge lies in market size. The industry’s relative youth and smaller market capitalization make it more volatile.

For context, the entire crypto market is currently worth the same as Apple alone. The former’s total market cap is $3.54 trillion, and the latter’s is $3.55 trillion.

There are many reasons why the crypto market may go down.

They range from elements native to the crypto industry, over those typically related to traditional finance, to global events.

Some are long-lasting, while others cause short-term drops. Some may lead straight into a crypto winter.

Here’s a comprehensive list of the key factors that can lead to a decline in the crypto market.

1. Negative Market Sentiment

- Investor panic: A variety of events may cause investors to panic and start selling. Panic can lead to widespread fear, uncertainty, and doubt (aka FUD). This, in turn, results in investors selling off their holdings, driving prices lower.

- Negative media coverage: For most of the crypto industry’s existence, media coverage has been akin to enemy fire. We have seen the situation improve with greater adoption. However, as seen with Terra, FTX, and others, frequent reports of fraud, hacks, or scams can make people fearful. This may lead to FUD and a mass sell-off.

- Loss of trust: Investors may lose confidence in the market as a whole or a specific cryptocurrency. It can easily occur during turbulent times, such as the bankruptcy and fraud events mentioned above. In these cases, investors are likely to exit, decreasing demand.

2. Market Corrections

- Bubble bursts: The cryptocurrency market may enter a speculative bubble, and this is a dangerous territory holders must learn to recognize. Prices will rise too quickly without any strong fundamentals. Ultimately, the bubble bursts, followed by a market crash.

- Profit-taking: In a situation where prices rise fast, early investors may decide to take profits. Subsequent sell-offs may cause the market to correct, depending on the investors’ size (aka how much they’re holding and selling).

- Overvaluation: It is not uncommon for projects to be overvalued based on speculative hype rather than underlying utility and fundamentals. Hence, the market may eventually correct downwards.

3. Fundamentals

- Transaction volume: Transaction volume plays a vital role in coin and token prices. In addition, total value locked (TVL), a measurement of activity on smart-contract blockchains, becomes an important fundamental measurement that can impact prices in either direction.

- Revenue: Mining or staking revenue reflects the health of the network by ensuring decentralized participation in consensus when revenues are strong.

- Chart technicals: Chart technicals often play a large role in trading, now magnified by automated trading. Traders worldwide make trading decisions based on technical indicators, which, in a relatively small market, can create a self-fulfilling prophecy.

4. Market Liquidity Issues

- Low liquidity: To remain stable, a market needs high enough liquidity. However, low liquidity makes a market more susceptible to large price swings. This can lead to rapid declines when large trades are made in either direction.

- Exchange delisting: We’ve witnessed many times the effect listing on a major exchange has on a coin’s price – climbing fast, even if briefly. But when a major exchange delists a coin, it can reduce its market exposure. Therefore, demand decreases as well, followed by a price drop.

5. Supply Issues

- Increased coin issuance: Once supply outpaces demand, the price falls. In other words, if a coin’s supply increases too fast (through excessive mining, token creation, etc.), it can dilute its value.

- ‘Pump and dump’ tokens: These coins are common and can flood the market. An influx of new, low-quality, or fraudulent tokens, especially if they are manipulated, can lower confidence in the market.

6. Regulatory Crackdowns

- Government regulations: Harsh regulations can have a significant negative impact on the market. We’ve seen banning or restricting crypto use, trading, or mining in various countries (for example, China) push the prices down.

- Regulatory uncertainty: Lack of clarity on crypto regulations in major markets is a significant pain point. It can cause investors to hesitate or pull out their investments due to fear of future restrictions or even penalties. Industry participants will often abandon that market for a more crypto-friendly one.

- Taxation changes: Increased taxes on crypto transactions or capital gains can lead to reduced demand.

- Crackdowns on illegal activities: Governments globally are increasing their efforts to track and shut down illegal cryptocurrency activities. This includes money laundering and tax evasion. Though these actions are illegal, crackdowns can still negatively impact the market.

7. Macro Events

- Geopolitical tensions: Political instability in countries that are heavily involved in crypto can have a major negative impact on the market. Declines will also occur in cases of economic sanctions imposed on such countries.

- Global events: While major global events can spur the use of crypto, they can also be a double-edged sword. Combined with one or more factors on this list, they can lead to sell-offs.

8. Global Economic Policy Changes

- Stronger regulations in major markets: Some large markets, especially in parts of Asia, are more crypto-friendly. But others commonly impose stringent crypto regulations, such as in the US. This may reduce the appeal of cryptocurrencies, causing prices to drop.

- Central bank tightening: Central banks can (and do) raise interest rates or reduce monetary stimulus. However, these moves can lead investors to pull funds out of risky assets.

9. Economic and Financial Factors

- Economic downturns: A general economic recession or financial crisis can be devastating for industries across the board, including crypto. It can cause investors to withdraw their money out of riskier assets.

- Stock market crashes: It has been debated how correlated these two markets are. Either way, a decline in traditional markets can easily lead to decreased investor risk appetite. Consequently, investors may sell off speculative assets.

- High interest rates: Crypto investments are less attractive during periods of high interest rates. Traditional investments like bonds and savings accounts may offer better returns.

10. Legal Actions Against Crypto Companies

- Lawsuits or shutdowns of crypto firms: Crypto companies and their executives have been fighting legal battles on several fronts. These battles, as well as government shutdowns of major crypto-related companies, such as exchanges and wallet providers, can undermine market confidence.

- SEC enforcement actions: The US Securities and Exchange Commission (SEC) has been one of the biggest (if not the biggest) thorns in the crypto industry’s side. The SEC’s action against major crypto companies can cause significant price declines for specific projects or the entire market.

11. Security Breaches and Hacks

- Hacks: Unfortunately not an uncommon event, hacks of cryptocurrency exchanges or wallets can easily lead to a loss of confidence in the market. As users’ funds are stolen, people may lose trust that their coins are safe. It is also unknown what the hacker will do with the stolen funds, as some choices may affect the market.

- Blockchain vulnerabilities: Security flaws or vulnerabilities are often discovered in blockchain networks and are commonly quietly patched before a bad actor finds both them and a way to exploit them. However, if there is a major, exploitable vulnerability found in a popular chain, it can cause a sharp decline in trust, potentially panic, and consequently, sell-offs.

- Phishing scams and fraud: In addition to hacks, scams, rug pulls, and fraudulent projects can discourage potential investors, causing the market to drop.

12. Market Manipulation

- Whale sell-offs: Large holders (whales) can manipulate the market by dumping a significant amount of their holdings, leading to large drops in prices. They can create artificial market movements by making large trades. When whales create a large sell order, the price can drop fast because it sends the signal to the market that that particular asset is in low demand.

- Pump-and-dump schemes: This is another, more sinister, price manipulation method. Groups create a project, artificially inflate its coin’s price, and then quickly sell off (dump) their holdings, causing crashes and harming investor sentiment.

- Excessive speculation: Excessive speculative trading without real utility or fundamentals can lead to a correction when the market realizes the price is unsustainable.

13. Increased Volatility

- Price manipulation: Excessive volatility is often caused by market manipulation or speculative trading. Importantly, it can easily scare off investors and cause prices to fall.

- Flash crashes: These are abrupt, short-term market crashes caused by large sell orders or algorithmic trading. While a buying opportunity to some, these events can lead to a loss of confidence in the market.

14. FUD (Fear, Uncertainty, and Doubt)

- Negative rumors: Rumors about project failures, regulatory crackdowns, or technological issues can lead to FUD, which can cause panic selling.

- Competition from central banks: If central banks introduce their own digital currencies, so-called central bank digital currencies (CBDCs), they may raise concerns about the future of decentralized cryptocurrencies and, hence, the reason to invest in them.

15. Declining Investor Interest

- Loss of interest from retail investors: Many of the listed factors can lead to the general public’s waning interest in crypto. This commonly occurs during a prolonged bear market. In this case, demand can significantly decrease.

- Exodus of developers: It is not uncommon for a project to be abandoned for a variety of reasons, including lack of funds or various illicit schemes. Either way, if developers leave a project or stop contributing, there is reduced innovation and slower progress, diminishing the project’s value in the market.

16. Decreased Access to Crypto

- Closing of payment gateways: Major payment processors like PayPal, Visa, or Mastercard opening their doors to crypto can significantly push the prices upwards. However, a reduction in their crypto-related service can create barriers for people entering the market, pulling the prices downwards.

- Exchange outages: Major exchanges and other crypto-related businesses can experience outages or shutdowns during times of volatility. On the one hand, this damages investors’ trust in the affected company. On the other, it prevents investors from buying or selling, potentially leading to panic selling when trading resumes.

17. Increased Competition

- Newer, better technology: The rise of newer, more advanced blockchain technologies that outperform existing ones may lead to a shift in investment. Older projects would lose value.

- Shifts in developer focus: Developers or key contributors can abandon one project for another they deem to be better.

- Forks and splits: A network can undergo a fork or split, which can cause confusion among investors and lead to major instability and market decline.

18. Negative Technological Developments

- Blockchain congestion: Blockchains can become congested due to high transaction fees or slow processing times, for example. This diminishes trust in a particular project and may make cryptocurrencies less attractive, especially if it happens frequently.

- Failure to scale: Many networks struggle to scale effectively, meaning they are unable to handle increasing demand. This can potentially undermine confidence and lead to a decline in price.

Technology failures: If the underlying technology or code behind a cryptocurrency is proven to be flawed or buggy, it can lead to significant declines in market value.

Is Cryptocurrency Safe to Invest In?

Investing in cryptocurrency comes with risks. However, key crypto assets, such as BTC and ETH, have far outperformed traditional investments in the past decade. To reduce risk in crypto investments, consider making crypto a limited part of a larger investment portfolio.

To reduce volatility, use dollar-cost averaging (DCA) to purchase a fixed dollar amount at fixed intervals. This strategy buys more of the asset when prices swoon and smaller amounts when prices spike, often reducing average costs in the long run.

Conclusion

These are the largest factors to keep in mind when discussing cryptocurrency market price movements.

Each of the above-listed factors can contribute to a downturn in the crypto market.

Notably, it is often a combination of two or more of these elements that impact the price movements.

Due to the market’s volatile nature, large enough events or changes can trigger sharp price movements.

This creates a potential for both rapid gains and significant losses.

Source: cryptonews.com