Solana (SOL) and its decentralized applications (DApps) ecosystem have experienced explosive growth, reaching an all-time high in revenue in November 2024.

A report from research platform Syndica revealed that Solana’s revenue hit $92 million, a 15x increase from $6 million in January, while Solana DApps generated a record $365 million, a 14x jump from $26 million in January.

Monthly Solana vs. Solala DApps revenue (Jan-Nov 2024). Source: Syndica

Decentralized finance (DeFi) remains the backbone of Solana’s DApp revenue, accounting for 83.7% of total earnings. Wallets contribute 9.6%, while the remaining 6.5% comes from infrastructure, non-fungible tokens (NFTs), and gaming applications.

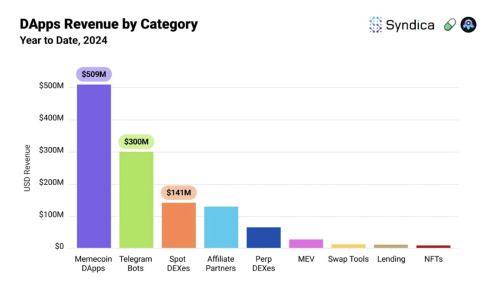

Meme coin DApps have emerged as a dominant force on Solana, generating a total of $509 million in revenue in 2024.

In November alone, this category earned $183 million, a 300-fold increase from January, when meme coin applications generated in a mere $600,000.

Solana DApps revenue by category, YTD. Source: Syndica

Pump.fun, a meme coin launchpad, became the first Solana DApp to surpass $100 million in monthly revenue, raking in $106 million.

This success, however, was not without controversy.

Pump.fun faced intense criticism in late November due to inappropriate content shared by users through its livestreaming feature, including alleged threats and acts of violence. This led the platform to indefinitely suspend livestreaming and promise to introduce stricter moderation to prevent similar incidents in the future.

The impact was immediate: Pump.fun’s weekly revenue plummeted 66% following the suspension.

Beyond Pump.fun, other key players driving Solana’s DApp revenue included Raydium, a decentralized exchange (DEX), Photon, a token discovery platform, and Jupiter, a Solana-based DeFi platform

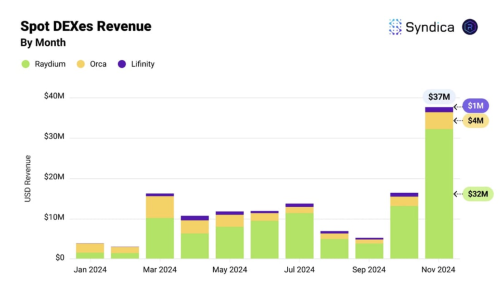

Raydium played a crucial role in driving spot DEX revenues to record highs. In November, Raydium earned $32 million, capturing 86% of total spot DEX revenue.

Monthly revenue from Solana-based DEXs (Jan-Nov 2024). Source: Syndica

Jupiter, a Solana-based DeFi platform, also achieved record revenue in November, reaching $17 million. This was largely driven by its perpetuals (Perps) trading feature.

Kamino Finance, another Solana-based DeFi protocol, hit a new all-time high in revenue, reaching $2.9 million. Lending remains its primary revenue source, contributing approximately 80% of its total earnings.

Even infrastructure providers like Helio are experiencing significant growth. Helio’s revenue surged to a new all-time high of $316,000 in November, representing a 7x increase since the beginning of the year.

Telegram bots have also carved out a significant niche, generating $300 million in revenue this year. These bots provide users with a convenient way to access and trade cryptocurrencies directly within the Telegram messaging app. Their popularity has grown alongside DEX volume, with Telegram bot DEX volume share stabilizing at 4-5% in recent months.

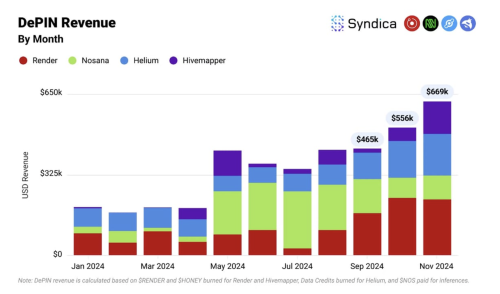

The report also highlighted the emergence of decentralized physical infrastructure (DePIN) as a growing sector.

Solana-based DePIN protocols like Render, Nosana, Helium, and Hivemapper leverage blockchain technology to provide real-world services, such as decentralized computing and data storage. These protocols have recently seen strong demand, leading to notable revenue growth.

The total revenue of Solana-based DePIN protocols reached $669,000 in November, a significant jump from the approximately $150,000 generated in January.

Render’s decentralized compute network is currently the largest revenue driver in the DePIN sector.

Monthly Solana-based DePIN revenue (Jan-Nov 2024). Source: Syndica

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…