Bitcoin Myths

Cryptocurrencies have become a part of everyday life over the years. But perceptions of the technology remain mixed. Some people's opinions are shaped by rumors, modern mythology, and conspiracy theories. We've compiled all the popular myths and misconceptions about Bitcoin in one place.

Cryptocurrencies have become a part of everyday life over the years. But perceptions of the technology remain mixed. Some people's opinions are shaped by rumors, modern mythology, and conspiracy theories. We've compiled all the popular myths and misconceptions about Bitcoin in one place.

1. Bitcoin is the same electronic money as in online banking, nothing new.

All electronic money that existed before cryptocurrencies was centralized, meaning it was controlled by the state and managed by banks and similar entities. Most often, such money was and remains pegged to national currencies. Balances reflected in users' bank accounts can be frozen or confiscated overnight. Furthermore, states, represented by central banks, can always print more fiat (regular, paper) money, since they alone have the monopoly power to issue it.

One of the main differences between Bitcoin and national currencies and electronic payment systems (EPS) is its decentralization. Bitcoins cannot be printed, as the maximum supply is strictly programmed and known in advance: 21,000,000, and not a single coin more. No one can arbitrarily destroy Bitcoin, as all computers connected to the Bitcoin network act as a single central authority, and the integrity of the blockchain is protected from various types of attacks by this vast computer network. Neither the source code nor any other rules can be changed without the consent of the majority of the community. Finally, Bitcoins cannot be blocked or confiscated if their owner directly controls access to their crypto wallet. To seize such a wallet, its owner must first be seized.

2. In reality, no one needs Bitcoin, because humanity already has gold, US dollars, euros, and so on. Bitcoin doesn't solve the problems that fiat currencies have.

The core functions of money, its intrinsic nature, are as a measure of value, a medium of exchange, accumulation, and payment. Gold and fiat currencies, as monetary units, are inferior in all respects to the opportunities offered by Bitcoin and some other cryptoassets.

As a medium of exchange: unlike gold, bitcoins are easy to store, take up little physical space, can be arbitrarily divided into very small pieces, and can be quickly transferred to another person regardless of distance. Unlike fiat money in the form of paper bills and coins, bitcoins cannot be counterfeited, do not wear out or tear (like paper), and do not need to be reissued.

Unlike a bank account, no documents or permissions are required to open an account on the Bitcoin network. Unlike a bank account, the owner can directly control a crypto wallet.

As a means of payment, all BTC transactions are transparent and visible to anyone with an internet connection. Once a payment has been made, it cannot be disputed with the excuse that “the money never arrived.” Unlike fiat money, which is accepted for payment within a specific country or countries, Bitcoin technically transcends national borders—it can be quickly transferred anywhere in the world.

As a store of value, Bitcoin has a predictable and decreasing supply. Furthermore, no central bank can print more Bitcoin at any time, which would lead to “Bitcoin inflation”—as happens with fiat currency.

3. Bitcoin is not backed by anything, it is just software code on the internet.

When we say a currency is backed by something, we mean that it's backed by a benchmark asset whose exchange rate the currency is pegged to. Bitcoin is valuable simply because it's backed by a multi-billion dollar industry: people constantly spend money on mining equipment, its maintenance and repairs, electricity, and, in industrial mining, on ASIC storage facilities, staff salaries, taxes, and other expenses. Investors, meanwhile, are willing to trade their real assets, like fiat money, for bitcoin.

On the other hand, all of this is difficult to quantify and cannot be used as a so-called “reference asset” to determine value security. This is why people say Bitcoin is backed by nothing—after all, BTC's value is based solely on how much people value the asset. Moreover, the higher the price of one BTC, the more people will attempt to generate coins, which in turn will increase the difficulty of generation and, consequently, make mining even more difficult.

The truth is that, in a sense, both government currencies and gold are unbacked. The value and worth of traditional monetary units depend on several factors, the most important of which is trust in the issuer (the central bank) and the belief that it will fulfill its obligations. But government defaults (refusals to repay government debt) have occurred even in large economies. Gold has held intrinsic value in the eyes of the people for thousands of years, serving as its own benchmark of value.

At first glance, gold isn't backed by anything, but people are willing to invest billions of dollars in gold, just like Bitcoin, for mining, processing, and making jewelry and other items. Gold, like Bitcoin, is backed only by the perceived value of the asset to those willing to accept it as an exchange equivalent. The general law of supply and demand applies here. The main factor determining Bitcoin's value is its global distribution and use.

4. Bitcoins are illegal because they are not recognized as a means of payment.

Bitcoin's legal status depends on the laws of a particular country. For example, in El Salvador, Bitcoin was recognized as legal tender in 2021. In some other countries, such as Japan, Bitcoin, although not considered legal tender, is a legal form of property and is used by certain market players (including licensed banks). The problem is that different countries may have their own restrictions on the use of Bitcoin, including as a means of payment: from a complete ban to partial restrictions, such as in “experimental legal regimes,” special economic zones, or in foreign trade transactions.

As for Russia, Bitcoin cannot be used as legal tender. BTC itself is not illegal—it is classified as a “digital currency,” and some uses are legal, but only as property. Mining is also legal in Russia, and there are even legally defined procedures for paying taxes on this activity.

However, in some countries, cryptocurrency is completely banned (Turkmenistan), or there are strict restrictions, such as in Bolivia, Afghanistan, and China. On the other hand, the global trend is moving toward flexible market regulation, so over time, the attitude of legislators toward the industry, even in the most restrictive jurisdictions, may well change.

5. Bitcoin harms economic stability and government currencies.

The claim that Bitcoin was created to destroy the traditional financial system and the economies of entire countries, or to undermine certain state structures, is completely untrue. Inspired by early cypherpunks, Bitcoin didn't emerge out of nowhere, but as a solution to the problems plaguing traditional finance. This was hinted at by Bitcoin's anonymous creator, Satoshi Nakamoto, in a hidden message within the genesis block, the first block of the first cryptocurrency's blockchain.

Cryptocurrencies remain one of many financial instruments whose use depends on who controls them. Bitcoin technology offers alternative solutions to many financial security issues. When used wisely, it can facilitate business and economic development. Moreover, some countries, including the United States, are seeking to establish their own Bitcoin sovereign reserves, believing that they can do more good than harm.

6. Cryptocurrencies facilitate tax evasion, causing serious damage to the global economy.

Today, even with the growing number of cryptocurrency transactions, the amounts that can be considered profit and the basis for taxation are, in most cases, negligible compared to similar turnover in national currencies. To claim that crypto is a means of tax evasion or that it will lead to the “fall of civilization” is fundamentally wrong.

On the contrary, legislators around the world are actively working on taxing transactions conducted using Bitcoin and other cryptocurrencies. It's important to understand that these legislative measures are complex. For example, in Europe, there is a regulation (MiCA) that governs KYC (know your customer) and AML (anti-money laundering) procedures. These requirements allow for client identification. Service providers are required to register. Issuers of, for example, stablecoins are required to report on collateral and reserves. All of this makes the industry more transparent and creates conditions for simplified tax collection—yes, even from the cryptocurrency industry, which has long been considered “tax-free.”

7. Bitcoins can be mined by anyone, therefore they are useless.

Bitcoin mining difficulty is currently very high and continues to increase. Bitcoins are mined not one at a time, but as a reward for each mined block. Every 210,000 blocks, the block reward is halved (the halving). While the block reward was 50 BTC in 2009, after the fourth halving in 2024, it dropped to 3.125 BTC. In 2028, the reward will decrease to 1.5625 BTC, and in 2032, it will be less than a bitcoin per block, reaching 0.78125 BTC.

Thanks to innovative developments in mining equipment, the overall network performance has increased manifold over the years, along with the increased complexity. Today, a home or office PC is incapable of providing the computing power required for mining. Profitable block mining requires investments ranging from hundreds of thousands to millions of rubles. Specialized hardware, such as ASICs, is required.

The usefulness or uselessness of a cryptocurrency is determined not by whether anyone can mine or mint it, but by whether the cryptocurrency will be used by people in their everyday lives.

8. Bitcoin is useless because it is based on untested/unauthenticated cryptography.

The concept of “untested and unprovable” cryptography is itself an absurd statement. The SHA-256 and ECDSA algorithms used in the Bitcoin network are now well-known industry encryption standards.

9. The first Bitcoin owners were unfairly rewarded.

The first users of the Bitcoin system were rewarded for using and testing a then-unwanted, little-understood, and unknown technology. These people were rewarded for taking on the risk of losing not only their time but also their personal wealth. There's a lot of injustice in our world, and the rewards for the first miners, the Bitcoin holders, hardly need be discussed.

Currently, approximately 94% of the 21 million coins have been mined, but even this declining supply will continue for many years to come. If you become a Bitcoin owner in the near future, many years from now, someone will also consider you an “early adopter.”

10. 21 million bitcoins are not enough to cover all the needs of humanity.

Anyone who makes such a claim forgets that one Bitcoin can be divided into units, the smallest of which is 0.00000001, or 1 Satoshi. This means that one Bitcoin is equal to 100 million Satoshi. So, if we're talking about the smallest unit, there will be over two quadrillion of them in the system. It's entirely possible that by the time the last BTC is mined, the units in circulation will be fractions of the smallest coin—millibitcoins (mBTC) and microbitcoins (µBTC).

11 Bitcoins are stored in wallet files, just copy the wallet and get more coins!

Bitcoins aren't stored in crypto wallet files, because, strictly speaking, coins don't exist in the traditional sense. If you own Bitcoin, a record is stored in the global distributed network (the blockchain) that you've been transferred a certain amount of Bitcoin, but you haven't spent it yet (these are known as unspent outputs, or UTXOs).

In this case, a crypto wallet simply becomes a means of accessing the network. The wallet.dat file, which is created when installing the wallet, contains private keys that grant the right to manage your coins (that is, to spend what's received at the address). Knowing the public address of the wallet where the coins are sent doesn't make anyone the owner of the wallet. No one can manage someone else's coins. In modern non-custodial crypto wallets, access is restored using a seed phrase. As long as your seed phrase is known only to you, no one else will have access to your cryptocurrency.

12. Lost coins cannot be replaced, and this is bad.

To date, a large number of lost bitcoins have been reported, most likely never to be used again. Coins are lost when a user loses access to their wallet, the wallet.dat file where private keys are stored, or the seed phrase. In most cases, this is the user's fault. Cryptocurrencies have no equivalent to banks. Therefore, all risks of storage and loss rest solely with the coin owner.

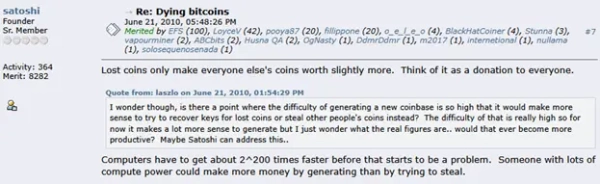

Why isn't there a mechanism for replacing lost coins? Because it's impossible to distinguish between lost coins and coins that are currently unused (temporarily, or in cold storage). Losing coins is an unpleasant situation for the user, but it's not a negative for the rest of the cryptoeconomy. Lost coins are an additional benefit of the deflationary model—the fewer coins there are, the more valuable the others become. As Bitcoin's creator once stated on the eponymous forum: “Lost coins make everything else a little more valuable, so think of the loss as a gift to everyone.”

13. Bitcoin is a giant financial pyramid.

A Ponzi scheme can be created using any cryptocurrency or any fiat currency. This technology shouldn't be confused with online projects that accept BTC as deposits at exorbitant interest rates, which are pure Ponzi schemes. Those seeking quick cash, having fallen for unrealistic promises, may blame the technology rather than those who deceived them.

Bitcoin itself isn't a Ponzi scheme or a scam, as it promises nothing to anyone. It's simply a technology that has proven to be quite popular in the market—so much so that people are eager to mine and buy BTC. Cryptocurrency shouldn't be viewed solely as a source of income. Although Bitcoin has appreciated in value over the years, it remains a means of payment. It's a technology, a way to generate new coins; every transaction, every wallet, is part of a single, vast system. Taken together, they have nothing to do with the concept of a “financial pyramid.” There's no regulator interested in (fraudulent) profits, no promises of easy multi-million dollar gains, just people building a new economy.

14. The Bitcoin idea won't work because there is no way to control inflation.

Inflation, in the common sense, is the rise in prices of goods and services over a given period of time. Price increases are typically the result of a depreciation of the currency relative to the goods and services. Inflation is possible, among other things, due to the constant increase in the money supply and the monopoly of money printing by governments. By printing new money, central banks dilute the value of the money already in circulation.

The key difference of Bitcoin as a payment system is its limited supply (21 million coins) and the absence of any bank/organization/government/other participant capable of “printing” more Bitcoins beyond the established limit, thereby diluting the value of the coins in circulation (initiating BTC inflation).

In fact, due to its growing popularity over the years since the Bitcoin network's launch and as demand for the cryptocurrency increased, its value has only increased, and the world has witnessed deflation, not inflation. Deflation is a decline in the value of goods and services relative to a currency.

15. The Bitcoin community is made up of geeks, anarchists, conspiracy theorists, and gold standard believers.

This was indeed the case in Bitcoin's early days. The cryptocurrency's creator, Satoshi Nakamoto, was clearly inspired by the ideas of the early cypherpunks. Although he did his best to maintain political neutrality, his comments on technological solutions and references in the genesis block revealed libertarian sentiments and a hacker mindset. Yifu Guo, the creator of the first mining systems and a longtime Bitcoin insider, echoed these sentiments in an interview, saying that the original motto of the early crypto enthusiasts was “better to go too far than to do too little.”

“Bitcoin, if we can explain it properly, resonates with the libertarian viewpoint. Although I'm better at writing code than I am at talking,” Nakamoto said.

As more and more enthusiasts discovered the potential to profit from Bitcoin's rising price, new players emerged in the industry: IT corporations, venture capital funds, retail chains, even banks and governments. In recent years, the number and influence of true crypto-anarchists has steadily declined. And it's unclear whether this is a good thing. After all, new ideas are best developed by enthusiasts, not administrators.

16. Any person with sufficient computing power can take over control of the network.

Taking over the Bitcoin network (performing a so-called 51% attack) is practically impossible today for economic and organizational reasons. Bitcoin is the largest decentralized computing network in the world, with a hashrate measured in hundreds of exahashes per second (EH/s). To attempt to gain control of more than half of this power, an attacker would need to invest an exorbitant amount of equipment and energy, estimated at billions of dollars.

Even if such an attack were hypothetically carried out and the network's stability were compromised, it could trigger a backlash from miners, users, and developers. The network would likely simply revert to the legitimate blockchain. Furthermore, the network is currently geographically distributed worldwide, with miners located in different countries and connecting to different mining pools. The network is considered most vulnerable to this type of attack in the first few years after its launch, but back then, Bitcoin's creator maintained its proper operation with his own computing power.

17. Points of sale accepting Bitcoin are not possible as it takes ten minutes to confirm the transfer.

Bitcoin-accepting locations are already available in various countries. McDonald's in Lugano, Switzerland, announced back in 2022 that it accepts BTC.

If payment for goods is made through electronic or banking systems, it can take anywhere from a few minutes to several days. Furthermore, the bank reserves the right to cancel the transaction, preventing the transaction from taking place. However, none of these circumstances hindered the growth of online commerce.

In fact, Bitcoin wallets typically require three to six confirmations before coins are available for transactions, meaning the wait time is about an hour. If payment is made on-site, then with BTC, the merchant understands the irreversibility of the transaction and doesn't need to wait for the required number of confirmations. Many online stores use a pre-paid system. Customers can top up their account and then spend cryptocurrency from it.

Rather, it's worth remembering the Copernican-Gresham law of economics, which states: “Worse money drives out better money.” It's unlikely that most people would want to exchange Bitcoin, which has been steadily appreciating and is often used for investment, for something less valuable. A cryptocurrency that's suitable for long-term investment but also fast and liquid is more suitable as a means of payment for microtransactions. For example, stablecoins.

18. After the last bitcoin is mined, no one will mine or generate blocks confirming transactions, as there will be no reward from the system for this. The system will collapse.

Once the costs of generation are no longer covered by the block reward, miners will be able to profit from transaction fees. It is expected that over the 100 years leading up to the near-zero supply, the Bitcoin network's turnover will be more than sufficient to compensate miners with fees alone. Furthermore, Bitcoin holders will be incentivized to generate new blocks, as their coins may become worthless if generation ceases.

19. The Bitcoin network does not have a built-in mechanism for reversing a transfer of funds, and this is bad.

The inability to reverse a payment is a built-in fraud protection mechanism. Responsibility for careful sending, trust in recipients, and the security of bitcoins rests solely with the owner.

Money transfer services like PayPal have a responsibility to prevent fraud. If you buy something on eBay and the seller doesn't ship it, PayPal debits the seller's account and returns the money to you. This strengthens the eBay economy, as buyers feel protected and are encouraged to make even riskier purchases.

Let's say you agreed to sell your goods or purchase bitcoins, transferred funds (sent the goods) to a fraudster, who sent you the coins but then reversed the transaction. If you have bitcoins, they are yours alone. Enabling a reversal mechanism in the blockchain would allow someone else to take your funds. You either have complete control over your funds or you are protected from fraud, but not both.

20. Quantum computers will break the security of the Bitcoin network.

Yes, theoretically, it's possible, but firstly, quantum computers capable of this don't currently exist. Secondly, if they were created, if the Bitcoin network's security were compromised, developers would be able to migrate the network to post-quantum cryptography.

There is, however, a problem: old addresses created in the early years of Bitcoin's existence (including addresses presumably belonging to the cryptocurrency's creator) that store huge reserves of coins are particularly vulnerable to quantum computers. If their owners fail to promptly transition to quantum-resistant address types, quantum computers will be able to access them, potentially causing major disruptions to the Bitcoin ecosystem.

On the other hand, as the quantum threat approaches, active users will be able to promptly switch to more secure address types—the main thing is to monitor developments and not miss the moment when quantum machines pose a real threat.

Moreover, it's important to consider that cryptography is used not only by cryptocurrencies, but also by all online stores, payment systems, exchanges, and, most importantly, banks. This means that the entire modern financial system is at risk. Cryptocurrencies, due to their flexibility, will be able to overcome the crisis faster than others.

21. Bitcoin generation is energy-consuming and harmful to the environment.

Indeed, the Bitcoin network consumes significant amounts of electricity, as its security is ensured by millions of specialized computing devices (ASIC miners). But the more computing devices involved in Bitcoin mining, the more stable the network becomes and the greater the economic costs incurred by miners. These costs are factored into the price of Bitcoin. This drives Bitcoin's price steadily upward, as miners' combined costs also increase.

Proponents of the Proof-of-Stake consensus algorithm (which powers Ethereum, for example) often point to Bitcoin's environmental concerns. However, unlike PoW, PoS networks face challenges with economic incentives, particularly the “nothing at stake” problem, which is often addressed through penalty systems.

The Bitcoin network's total energy consumption is estimated at approximately 100-150 TWh, which is comparable to that of some countries (for example, Poland, Norway, or Malaysia). However, this figure doesn't mean mining is entirely harmful to the environment. More and more mining companies are using renewable energy sources, such as solar, hydroelectric, and wind. Sometimes, they use excess or recycled energy, such as associated petroleum gas, which would otherwise be flared at the mines.

The share of clean or renewable energy in Bitcoin mining is steadily growing. Moreover, in colder countries, the heat generated by mining is sometimes used for heating. For example, in Finland, the mining company Marathon provides district heating to a city of over 60,000 people.

In other words, the claim that Bitcoin is harmful to the environment is rapidly becoming obsolete. The network's energy consumption is the price paid for its security, independence, and sustainability, and recent trends show that this process is becoming increasingly efficient and environmentally friendly.

22. Sellers cannot set prices for goods in Bitcoin due to the unstable exchange rate.

Owners of large stores, small retail outlets, and online resources often use payment gateways to accept Bitcoin, which transparently convert payments from BTC to national currencies and vice versa. Sellers set the price of goods in their local currency. Buyers pay in Bitcoin, which is converted into this currency without affecting the price of the goods—sellers always receive the desired result, regardless of the Bitcoin exchange rate and its volatility.

Moreover, as the Bitcoin ecosystem develops, payment solutions are improving. For example, solutions based on the Lightning Network protocol are increasingly being used, allowing for the blockchain to be offloaded and transaction speeds to be increased.

23. Bitcoins can be liquidated by governments because they are illegal and used by criminals.

Bitcoin cannot be liquidated because it has no centralized governance mechanism. There is no single information repository or centralized management, no single point whose failure (or ban) could lead to the collapse of the entire network. No state can order the liquidation of the cryptocurrency. The most forceful government intervention would be to ban the use of cryptocurrency for transactions in a specific country; this unpopular approach is unlikely to be widespread.

An attempt to issue an alternative currency in the US (the Liberty Dollar) was once considered fraudulent and counterfeit, although it's clear that such “private money” undermines the state monopoly on monetary issuance. Bitcoins, however, are not used as physical coins and are not issued by any specific entity that could be subject to sanctions by governments. Moreover, governments are gradually recognizing Bitcoin as a store of value and, at a minimum, as property—even countries like the US are gradually building up their own national Bitcoin reserves.

24. Is Bitcoin a quick way to make money online or a high-yield investment?

Bitcoin gained its notoriety largely due to its explosive price growth in 2013 and numerous “success stories” in the media. The more appealing the story of the next Bitcoin millionaire appears, and the more people hope for quick, super-profits from the cryptocurrency, the more likely it will be for scammers to emerge using BTC as bait.

Of course, there are countless examples proving that investing in Bitcoin has been a successful investment at various times, and that its value can grow significantly, making investors rich. But this doesn't mean the success story is endless. It's possible to suffer losses from investing in BTC. No one can guarantee a profit, as there's a non-zero chance that Bitcoin will eventually depreciate. It's important to remember: any investment—whether in gold, stocks, real estate, cryptocurrency, or business—is always risky. Investing in your first cryptocurrency is unlikely to deliver impressive results anytime soon.

History shows that Bitcoin's price can be quite unpredictable over several years. Even sound investments don't promise quick returns, and Bitcoin shouldn't be viewed as a way to get rich quickly without risk.

The following recommendation is recommended: if the exchange rate is favorable and you have some spare cash, purchase a small number of coins and store them in a cold storage crypto wallet. The main thing is not to expect this investment to bring you fabulous wealth anytime soon. The time of rapid growth by tens and hundreds of times, as it did several years ago, is long gone—back then, the so-called “low base effect” was in effect. This is when Bitcoin's price growth, relative to the global economy, was laughable. But now its market capitalization is disproportionately higher, and large investors are investing in the coin, so astronomical growth in a short period of time is unlikely.

25. You can make money by simply installing the main client on your computer.

Installing a Bitcoin client won't immediately earn you anything. Back in the early days of Bitcoin, people would install the program on their computers or laptops, enable mining, and mine cryptocurrency using their CPU power. Now, only specialized farms, which occupy large areas and consume enormous amounts of electricity, can boast sufficient computing power to profitably mine Bitcoin. This method of earning money—generating coins on a home computer—is effectively no longer available. However, CPUs and even hard drives can mine coins from some Bitcoin forks and other projects. However, the profitability of this activity rarely covers even the electricity costs.

26. Bitcoin is an anonymous cryptocurrency.

In fact, Bitcoin isn't completely anonymous. Discussions about anonymity emerged in the first years after the project's launch—back then, the first cryptocurrency was actively compared not to other cryptocurrencies, but to electronic fiat payments. Clearly, a Bitcoin transaction is more anonymous than, say, a bank transfer. The bank itself knows who transferred what, when, and to whom, and there's no way you can hide your identity from the bank when transferring money from your personal account.

In the Bitcoin network, users are anonymized and hidden behind addresses. Through the blockchain, we can see from which address to which and when a certain amount of coins was transferred. But we don't know directly through the blockchain who owns each address.

However, the industry is evolving, and over the years, services have emerged that allow tracking all publicly available information on the blockchain, comparing transfers with known recipients, and monitoring fund flows in every possible way. Therefore, over the years, Bitcoin's anonymity has come to be called ” pseudonymity .”

Today, the cryptocurrency market includes altcoins that address privacy issues much better. For example, Monero uses ring signature technology to obfuscate the trail, while Zcash is based on zero-knowledge proof protocols. These cryptocurrencies are more modern than Bitcoin, and they are already considered anonymous. Perhaps even more advanced solutions will emerge in cryptography in the future.

Source: cryptonews.net