The crypto market is up today amid expectations for crypto-friendly policies in the US, the US Federal Reserve rate cuts, the European Central Bank (ECB) lowering its key interest rates, and the People’s Bank of China cutting its benchmark one-year lending rate.

Some analysts argued that Bitcoin could hit $160,000 by 2025, further bolstered by the US economy.

Others noted that BTC could surge to $200,000 by mid-2025.

At the time of writing, the global cryptocurrency market capitalization is unchanged. Over the last 24 hours, it recorded just a 0.1% increase, now standing at $3.94 trillion.

The daily crypto trading volume is $296 billion.

Also, 66 of the top 100 coins per market cap have seen their prices decrease today, while 44 have appreciated.

Nonetheless, all individual categories are up on average.

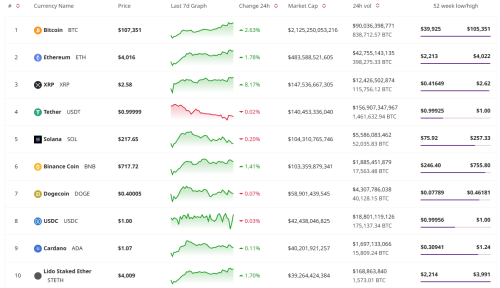

The majority of the top 10 coins per market cap have seen their price rise today.

Only two coins are down, both than less than 0.5%, meaning that their prices are unchanged.

The two coins are Solana (SOL) and Dogecoin (DOGE), currently trading at $217.65 and $0.40005, respectively.

The day’s best performer is XRP (XRP). It appreciated 8.2% to the price of $2.58.

The rest of the green list is up between o.1% and 2.7%.

Bitcoin (BTC) increased by 2.6%, trading at $107,351, after hitting a new all-time high of $107,822 on 16 December.

Ethereum (ETH) appreciated 1.8%, changing hands at $4,016.

Speaking of Ethereum, its largest whale wallets now hold 57% of the total ETH supply. The top 104 whale wallets, each holding over 100,000 ETH, collectively control around $333 billion worth of the coin.

Also, on Monday, Ethereum spot exchange-traded funds (ETFs) saw a 16th consecutive day of net inflows, recording $51 million.

Meanwhile, the defunct crypto exchange Mt. Gox moved $172.54 million in BTC to an unknown wallet earlier today.

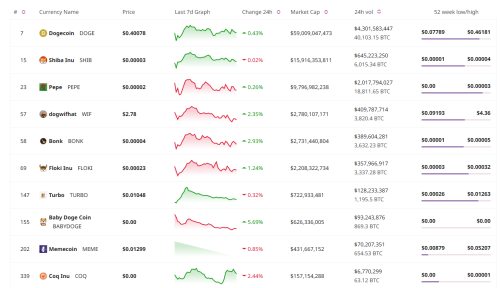

Most of the top meme coins are up today, while four are down.

Coq Inu (COQ), yesterday’s biggest gainer, decreased the most today: 2.44%.

The other three coins are down below 1% per coin.

At the same time, the increases range between 0.2% and 5.7%. The latter percentage is recorded by Baby Doge Coin (BABYDOGE) as the day’s best performer.

It’s followed by Bonk (BONK)’s increase of nearly 3%.

The category’s first coin per market cap, Dogecoin (DOGE), increased 0.4% to $0.4, while the second coin, Shiba Inu (SHIB), remained unchanged at $0.00003.

As for BABYDOGE, the team behind it announced today that the coin would enter the Korean market via the listing on the KCEX spot trading market.

They are also preparing to launch the puppy.fun meme coin launchpad in a matter of days.

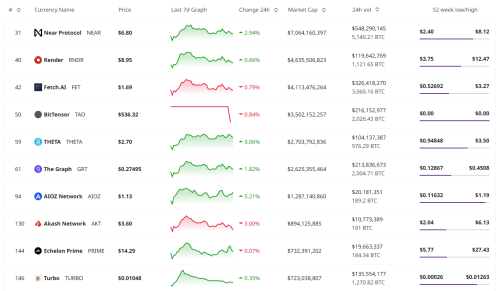

Four of the top AI coins recorded drops in their prices over the past 24 hours.

While three fell below 1% per coin, Akash Network (AKT)’s price decreased by 3% to the price of $3.6.

On the other hand, AIOZ Network (AIOZ) increased by 5.2% to $1.13, making it the day’s best performer.

Theta (THETA) follows with a rise of 3% to $2.7.

Near Protocol (NEAR), the top coin in this category, is up nearly 3%, now trading at $6.8.

Meanwhile, the AIOZ team tweeted today that the SOLO mining chain integrated AIOZ W3IPFS for decentralized file storage, thus enhancing data storage efficiency and user experience.

On Monday, the team said it had presented a study titled ‘Surpassing State-of-the-Art VQA with Deep Learning Optimization Techniques and Limited GPU Resources’ at NVIDIA GTC 2019, sharing key insights on optimizing GPUs for deep learning and showing how they developed an “efficient Visual Question Answering (VQA) system using limited resources.”

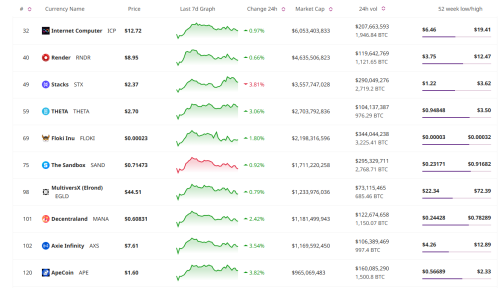

Only one of the top ten metaverse coins has recorded an increase over the past 24 hours.

While the best performer yesterday, Stacks (STX) is the category’s only drop today, having decreased by 3.8% to the price of $2.37.

The highest increase is ApeCoin (APE)’s 3.8%, currently trading at $1.6.

It’s followed by Axie Infinity (AXS) and its 3.5% rise to the price of $7.61.

The top two coins in this category, Internet Computer (ICP) and Render (RNDR), are up below 1% each, changing hands at $12.72 and $8.95.

Meanwhile, ApeChain announced its latest integration today, this time with Orbiter Finance, while on Monday it said that Cyan, a buy now pay later service for the metaverse, went live on ApeChain.

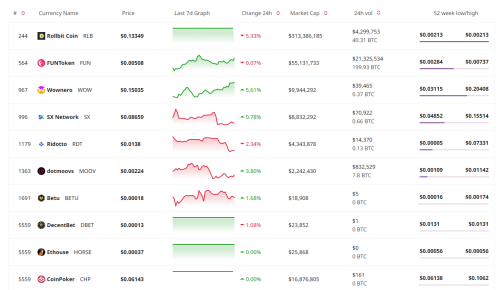

The top 10 gambling coins did not do as well as the previous categories.

Its daily increase of 0.1% is so minimal that the average is practically unchanged.

Four coins have recorded increases. Two more are technically green but are unchanged.

Wownero (WOW) rose by 5.6% to $0.15035, making it the category’s best performer.

Dotmoovs (MOOV) comes next, having seen a 3.8% rise to the price of $0.00224.

Other green coins are up 1.7% and less.

As for the red coins, Rollbit Coin (RLB), the category’s top coin, fell the most: 5.3% to $0.13349.

The rest of the list is down between 0% and 2.4%.

Dotmoovs recently partnered with Kutsaca, a Mozambique-based organization that empowers vulnerable children through sports, creativity, and education. The team is preparing “a special event” to celebrate this collaboration, they said.

The cryptocurrency market is influenced by a wide variety of factors. Each may affect it differently, but the price will likely reflect it.

Some of these factors are close to home, so to speak. However, some are seemingly far removed yet intertwined with the crypto market to a certain degree.

Here’s a comprehensive list of key reasons why the crypto market might go up.

These are the largest factors to keep in mind when discussing cryptocurrency market price movements.

It is important to remember that they are not isolated from each other. Rather, each is typically intertwined with several others on this list.

Therefore, each of these factors can act individually or in combination to influence the price movements of cryptocurrencies.

Often, the market is a dynamic interplay of many of these elements. This, in turn, creates the volatility that crypto markets are known for.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…