When discussing initial coin offerings (ICOs), terms like “soft cap” and “hard cap” are often used to define a project’s fundraising goals and limits. These caps are critical for understanding how much a particular project aims to raise and the implications for investors. Knowing the difference between soft cap and hard cap can help potential investors make informed decisions about participating in an ICO.

Understanding these terms is essential for anyone looking to invest in a cryptocurrency project. Choosing to base your project on soft cap vs hard cap influences the fundraising strategy, as well as the overall credibility and attractiveness to investors. This article will explore the definitions, purposes, and impacts of these caps in the context of ICOs.

Let’s start by breaking down the soft cap and hard cap meaning.

A soft cap refers to the minimum amount of funds that a cryptocurrency project needs to raise during its initial coin offering (ICO) to ensure that it can proceed with its development and operational plans. This threshold is set to ensure that the project has sufficient resources to cover essential expenses such as development, marketing, and other operational costs. The soft cap acts as a benchmark to measure the initial success and viability of the project.

When a project announces its ICO, it outlines a detailed plan that includes its funding requirements. The soft cap is an integral part of this plan, as it reassures potential investors that the project team has carefully calculated the minimum amount needed to move forward. If the soft cap is reached, it typically triggers a timeline or countdown for the end of the presale, signaling to investors that the project has met its initial funding goals and is on a path to development.

Reaching the soft cap also has psychological benefits for both the project team and investors. For the project team, it validates their concept and gives them the confidence to proceed with their plans. For investors, it provides a level of assurance that the project has garnered enough support to be considered viable. Most of the best ICOS on the market reach their soft cap, which can lead to increased investor confidence and potentially attract more contributions as the project moves forward.

When the soft cap fails to reach its target, it can have significant implications for both the project and its investors. In most cases, the presale remains open until the minimum fundraising goal is achieved. However, if the soft cap is not met within a specified period, the ICO might be considered unsuccessful.

This scenario often leads to the project team refunding the contributions made by investors, as failing to reach the soft cap suggests that there isn’t enough support or interest to sustain the project’s development.

Investors should be cautious and do their due diligence before investing in a project that has not yet reached its soft cap. Monitoring the progress of the presale and the speed at which funds are being raised can provide a significant amount of insights into the project’s potential success. A slow or stagnant fundraising effort might indicate issues with the project’s appeal or marketability, which could be a red flag for potential investors. A study from MIT last year found that over 50% of ICOs failed last year.

Let’s delve deeper into the hard cap vs soft cap debate, and get more insights into what is hard cap in crypto.

On the other hand, a hard cap is the maximum amount of money that a project aims to raise during the ICO. Once this limit is reached, the fundraising process automatically finishes, regardless of whether the presale period is still ongoing. The hard cap is set to control the total supply of tokens and manage excess demand. When a project hits its hard cap, it is a strong indicator of high investor interest and demand.

Projects that reach their hard cap during the presale stage often signal strong market confidence and potential for future success. This cap helps maintain a delicate balance between demand and supply, ensuring that the project doesn’t raise more funds than necessary, which could lead to issues in managing the funds effectively.

Both the soft cap and hard cap are crucial for an ICO’s success. The soft cap ensures that the project has enough initial funding to be viable and to deliver on its promises. Without reaching this minimum threshold, the project may lack the necessary resources to proceed, potentially jeopardizing its development and investor returns.

The hard cap, on the other hand, prevents the project from raising excessive funds, which could lead to management challenges and diluted token value. By setting a maximum limit, the project can ensure that it raises an appropriate amount of capital while maintaining investor confidence and interest.

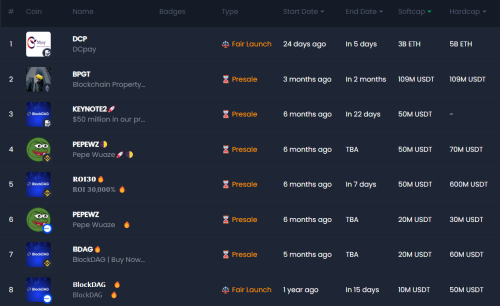

Firstly, researching the soft and hard cap details before investing in an ICO is a wise decision. These figures provide insight into the project’s fundraising goals and potential success. Here are a few ways to find these details:

Understanding the concepts of soft cap and hard cap is essential for any person considering participation in a cryptocurrency ICO. These caps not only define the fundraising limits but also provide a certain amount of insights into the project’s viability and investor demand.

By thoroughly researching these aspects, investors can make more informed decisions and better assess the potential risks and rewards of their investments.

A soft cap is the minimum amount of funds a project needs to raise to proceed with development, while a hard cap is the upper limit on the amount of funds the project aims to raise before the ICO ends.

Crypto presales use soft caps to ensure the project has enough initial funding to be viable and hard caps to prevent raising excessive funds, which helps maintain balance and investor confidence.

A low soft cap can be good as it indicates the project requires minimal funding to proceed, which might appeal to cautious investors. However, it should still be realistic to cover the project’s development needs.

A high hard cap is not necessarily bad, but it should be justified by the project’s scope and potential. It can indicate high demand, but if set too high without justification, it could lead to management challenges and diluted token value.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…