Coinbase and Binance boast over 105 million and 230 million users, respectively. This makes them the most popular cryptocurrency exchanges globally. But which platform is better in 2024?

This Coinbase vs Binance comparison explores fees, supported coins, trading features, security, and more. Read on to choose the right crypto exchange for you.

Overall, there’s no one-size-fits-all answer to whether Coinbase or Binance is the better exchange. It all depends on the user’s priorities and goals. Coinbase is by far the safer exchange, with strong regulations in multiple countries and robust security features and custodianship.

After all, Coinbase is responsible for safeguarding institutional investments, including multi-billion dollar Bitcoin ETFs. Coinbase is also a public stock on the NASDAQ, meaning it must release quarterly financial statements and comply with enhanced regulatory scrutiny and demands. However, Coinbase charges significantly higher fees than Binance.

The maximum trading commission on Binance is 0.1%. Coinbase charges standard commissions of 1.49%, or up to 1.2.% when using its Advanced platform. Coinbase also charges 3.99% when buying crypto with instant payment methods. Binance also offers a much larger number of markets, especially in the spot trading department.

It also offers better options for earning passive yields, including dual investments and savings accounts. Binance also offers higher leverage on perpetual futures: 125x to Coinbase’s 10x. Ultimately, it’s a choice between safety and security or low fees and diverse market access. It’s also important to note that Coinbase ended up on our list of best Binance alternatives.

Coinbase: 7/10

Binance: 8/10

Let’s begin this Coinbase vs Binance comparison by exploring supported cryptocurrencies.

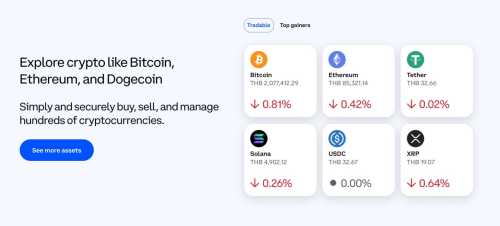

Coinbase supports 258 coins and tokens, compared to Binance’s 424. Both platforms offer crypto pairs in multiple fiat currencies, such as BTC/USD, BTC/EUR, and BTC/AUD. However, Binance not only has more coins and tokens than Coinbase but considerably more markets. Currently, Binance offers 1,668 trading pairs to Coinbase’s 406.

This means Binance is the better option for active traders seeking asset diversity and long-term investors looking to build a highly diversified portfolio of digital assets. That said, beginners will find Coinbase’s asset suite sufficient, considering it supports the best cryptocurrencies, including popular coins like BTC, ETH, SOL, XRP, and DOGE.

Please note that Coinbase doesn’t support BNB, Binance’s native coin. Other major omissions include ADA, TON, TRX, and LEO.

Coinbase: 4/10

Binance: 9/10

Coinbase scores poorly in the fees department. This is its biggest drawback; fees are considerably higher than the market average. Especially when compared to Binance.

Let’s break the fee schedules down in more detail.

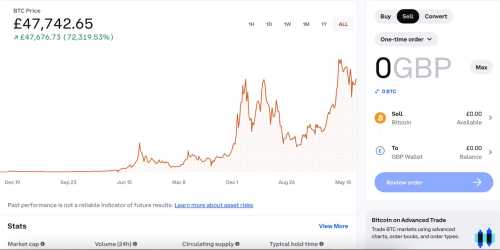

Coinbase has two spot commission models, depending on which exchange is used. The standard Coinbase exchange, which is aimed at beginners, charges a standard commission of 1.49% per slide. This is charged when buying and selling cryptocurrencies with fiat money and swapping cryptocurrencies, such as Bitcoin and Ethereum.

Coinbase Advanced – which is aimed at experienced traders, has lower commissions. However, the commission depends on whether traders place a market or limit order. The maximum fee charged by Coinbase Advanced is 1.2% for market orders and 0.6% for limit orders. Discounts are available when trading larger amounts, similar to Binance.

The maximum trading commission at Binance is 0.1% per slide. This is significantly cheaper than Coinbase. For example, suppose you purchase $2,000 worth of Bitcoin. You’d pay a commission of just $2 at Binance. At Coinbase, you’d pay $24, based on a 1.2% commission. What’s more, Binance also offers discounts when holding BNB. This reduces the spot trading commission by 25%.

Coinbase notes that perpetual futures can be traded from 0% when placing limit orders.And from 0.03% on market orders. However, there are some issues to consider. First, these fees are only available to non-US traders. Second, and most importantly, Coinbase states that the actual fees paid will vary depending on where the user is based.

These alternative fees aren’t published, meaning users must check their accounts to know what they’re being charged. For us, this is a major drawback, as it lacks the transparency expected of exchanges. In contrast, Binance is considerably more transparent, with futures fees clearly displayed.

So, those trading under $15 million within 30 days pay the maximum commission of 0.02% or 0.05%, depending on whether they’re placing limit or market orders. These fees are discounted as trading volumes increase, and those placing limit orders get the biggest fee reductions.

Coinbase offers an instant buy feature. This allows users to buy cryptocurrencies immediately with a debit/credit card, Google/Apple Pay, and PayPal. Coinbase charges a whopping 3.99% for this service and even more when spending under $200.

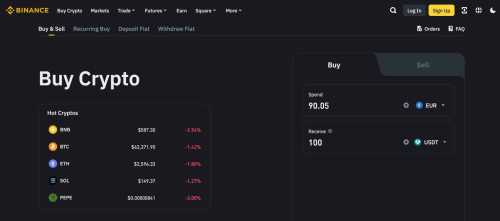

Binance also has an instant buy feature, with debit/credit card fees averaging 2%. However, fees can vary wildly depending on the user’s location. Therefore, users should evaluate fees before proceeding.

Coinbase users can also deposit fiat money directly into their accounts. Those funds can then be exchanged for cryptocurrencies. Crucially, there are no fees when using local banking methods, such as ACH and Faster Payments. Coinbase doesn’t charge account fees, so cryptocurrencies can be stored at no extra cost.

Those using Coinbase’s staking service will pay fees of up to 35%. This is deducted from the staking rewards in the respective coins or tokens.

Binance also enables users to deposit funds manually via local banking methods. No fees are charged. Another option is Binance’s P2P platform. This also comes without fees, but sellers state the quoted exchange rate. Binance also offers free wallet storage. However, just like Coinbase, staking fees of up to 35% will apply.

Coinbase: 6/10

Binance: 9/10

This Coinbase vs Binance comparison will now explore trading tools and features.

Most Coinbase users opt for the standard platform, which enables them to buy, sell, and trade cryptocurrencies with fiat money. Instant conversions are also available, such as swapping Litecoin for Ethereum or Bitcoin for Solana. While Coinbase’s standard platform is ideal for beginners with limited experience, fees are much higher than those of Coinbase Advanced.

Nonetheless, Coinbase Advanced is the best option for those seeking high-level trading tools. It is similar to Binance’s advanced exchange and covers technical indicators, charts, drawing tools, trend lines, order books, and customer order types. These features will be alien to novice traders, which is why the standard platforms are so popular.

Eligible Coinbase users can trade perpetual futures. Leverage of up to 10x is available, converting to a minimum margin requirement of 10%. Just six perpetual markets are available: BTC, ETH, LTC, XRP, SOL, and AVAX.

In contrast, Binance offers hundreds of perpetual markets, and the maximum leverage is 125x. This includes some of the best meme coins, such as FLOKI, Pepe, WIF, DOGE, and SHIB. Binance also offers delivery futures with multiple settlement dates. It also supports options markets for BTC, ETH, BNB, XRP, and DOGE.

Coinbase also falls short when it comes to automated trading. No passive trading tools are available.

Binance is a great option for automated systems. It offers thousands of in-house trading bots, covering over 104,000 pre-built strategies. Bots support futures and spot trading across any cycle, including sideways, bearish, and bullish markets. Binance bots are free to deploy, although profit-sharing agreements are sometimes in place.

Binance also offers a copy trading service. Thousands of traders are available, and users can choose one based on their preferred markets, return on investment, and other important metrics.

Coinbase offers staking rewards on 152 cryptocurrencies. For example, APYs are 2.38% for ETH, 4.87% for SOL, and 1.85% for ADA. Users can unstake at any time, and Coinbase takes up to 35% of the rewards generated. Binance also implements this fee structure.

That said, in most cases, Binance offers more competitive APYs. For example, users get 3.14% for ETH and 2.19% for ADA. However, SOL pays slightly less at 4.39%. Binance also offers savings accounts and dual investments. It also offers the choice between fixed or flexible terms, which will impact the available interest rates.

Binance offers a free demo account for futures trading. This is a great way to develop futures trading strategies without risking capital, as the demo platform mirrors real market prices.

Coinbase doesn’t offer demo accounts.

Binance: 8/10

Coinbase: 9/10

In addition to security and regulation, Coinbase is one of the best crypto exchanges for user experience. It’s often the go-to exchange for those investing in cryptocurrencies for the first time. It takes minutes to open an account, and users can instantly buy cryptocurrencies with a convenient payment method, such as PayPal or debit/credit cards.

There’s no need to manage cryptocurrencies in a private wallet, as Coinbase offers fully-fledged custodial services. Coinbase also makes it simple to swap cryptocurrencies. For instance, a user holding ETH can instantly swap those coins for XRP. Speaking with customer service is also straightforward via the live chat feature.

Binance also offers a great user interface and experience. Although it’s not the first choice for beginners, it is better suited for intermediate to advanced traders. This is because it offers high-level analysis tools, huge leverage limits, and customizable charts. It also offers high-risk earning products like dual investments.

Nonetheless, Binance also offers simplified features that will be more appealing to newbies. This includes an instant buy platform. Users select their local currency (e.g., EUR), their preferred digital asset (e.g., USDT), and the amount. Users are then guided through the payment process.

Coinbase: 9/10

Binance: 9/10

Next, in this Coinbase vs. Binance comparison, we’ll discuss the mobile experience. Coinbase offers two apps, both supporting iOS and Android. The primary app connects with the Coinbase exchange and offers all of the features available on the desktop website, such as trading, swaps, deposits, withdrawals, and price alerts. The second app is the Coinbase Wallet.

This is a non-custodial wallet and a unique entity, meaning that Coinbase Wallet doesn’t connect to the Coinbase account. It offers anonymous storage and, most importantly, full control of the wallet’s private keys. However, Coinbase can’t help if the wallet is compromised, considering they have no access to the wallet credentials. Therefore, beginners might prefer Coinbase’s main wallet, which is accessible online and via the primary app.

Binance offers a similar mobile experience to Coinbase. It, too, offers a primary mobile app that connects to the main Binance exchange. It supports spot and futures trading, payments, charting analysis, and more. Binance also offers a Web3 wallet app. Just like the Coinbase Wallet, it offers non-custodial storage, swaps, and earning tools.

Coinbase: 9/10

Binance: 8/10

Coinbase is excellent when it comes to payments. Granted, fees on certain payment types are significant. But the process itself is seamless. Those using a debit/credit card, PayPal, or Google/Apple Pay will be charged 3.99% of the purchase amount.

However, depositing funds manually via a local bank transfer is free. What’s more, the payment often arrives in minutes. Additionally, Coinbase supports multiple fiat currencies, including USD, CAD, GBP, EUR, and AUD.

Binance’s payment department isn’t as extensive in some countries. For example, it no longer supports GBP payments, meaning UK clients will need to consider another platform. Moreover, fees vary depending on the user’s country. That said, we found that the average debit/credit card fee is 2%. So, if it’s supported in your home country, Binance is cheaper than Coinbase.

Coinbase: 9/10

Binance: 9.5/10

Having tested the customer service department manually, Coinbase and Binance both score highly. Live chat is freely available 24 hours per day, 7 days per week. Waiting times are almost always near-instant.

That said, Coinbase just beats Binance, considering it also offers telephone support. Local toll numbers are available in the US, UK, Ireland, Germany, Spain, Brazil, and France.

Coinbase: 10/10

Binance: 6/10

The final section of this Binance vs Coinbase comparison will discuss regulation and safety. Put simply, Coinbase is perhaps the safest exchange globally. It holds regulatory licenses in multiple countries, including the US, UK, Canada, Singapore, Australia, and the European Union.

The latter was obtained by the Central Bank of Ireland, which provides a passport to the broader European continent. Coinbase is also a public stock, trading on the NASDAQ since April 2021. This means Coinbase is legally required to publish financial statements every three months. This offers a level of transparency like no other.

Coinbase also offers institutional-grade security measures. It keeps 98% of client-owned funds in cold wallets, protected by 24/7 guards. It also offers two-factor authentication (2FA) and IP/device whitelisting. Coinbase has never been hacked, which is testimony to its robust security framework.

Is Binance safe? Things aren’t quite as straightforward at Binance. Sure, it offers cold storage, 2FA, and proof of reserves. But Binance was previously hacked for over $570 million. This is in addition to Binance’s money laundering failures, which resulted in a $4 billion charge from US authorities. Therefore, Coinbase is significantly more secure than Binance.

You should now be able to choose between Coinbase or Binance, depending on your main requirements. Those seeking low trading commissions and a wide selection of spot and futures markets may prefer Binance. This is also the case for high-risk traders seeking leverage, with Binance offering up to 125x.

Coinbase, however, also serves a purpose. It’s the best cryptocurrency exchange for those prioritizing safety, transparency, and regulation. Not to mention smooth fiat payments, a beginner-friendly experience, and top-notch customer support.

Binance is better than Coinbase in terms of fees, available markets, and more advanced trading features and tools. Coinbase is the better option for security and regulation, as well as for those investing in crypto for the first time.

Binance has transparent proof of reserves, 2FA, cold storage facilities, and a self-funded insurance fund. However, Binance was previously hacked for over $570 million, so this should be taken into account.

Yes, Coinbase is perhaps the most trustworthy exchange in this industry. It’s a public stock on the NASDAQ, is heavily regulation, and offers institutional-grade security tools.

Binance is bigger than Coinbase across most measurable metrics, including registered users, trading volumes, and liquidity.

Yes, but US citizens must use the Binance.US platform, which comes with fewer markets and trading features.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…