Demand for Bitcoin ETFs remains weak

The lack of demand for Bitcoin spot ETFs is raising concerns about the cryptocurrency's prospects for the rest of the year. This situation persists even as the US government appears to be nearing the end of its 41-day shutdown.

On Monday, the US Senate approved the funding package, taking a major step toward ending the government shutdown. The bill now heads to a full House vote, which could take place as early as Wednesday, CBS News reported Monday.

Senate Majority Leader John Thune said he hoped the package would pass within “hours, not days,” during a Senate morning session Monday, according to Military Times.

Despite the upbeat news out of the US, investment in spot Bitcoin ETFs remained flat on Monday, with just $1.2 million in inflows, according to Farside Investors.

Bitcoin ETF Fund Flows, USD (in Millions). Source: Farside Investors

“Even though the US government shutdown appears to be ending and both the S&P and gold are posting strong gains, Bitcoin ETFs saw little demand yesterday,” said Capriole Investments founder Charles Edwards.

He added that this is not a dynamic that he would like to see continue.

“Risk assets typically see strong demand in the weeks following the end of the shutdown. There's still time to reverse this situation, but a reversal is necessary,” he added.

Previously, the influx of funds into spot Bitcoin ETFs was considered the main driver of Bitcoin growth in 2025, as noted by Jeff Kendrick, global head of digital asset research at Standard Chartered.

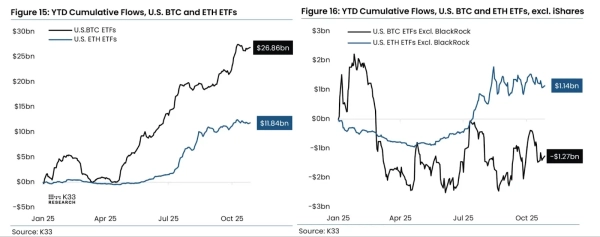

Source: Vetle Lunde

BlackRock was the only fund to see positive inflows year-to-date, attracting $28.1 billion. Meanwhile, other issuers saw a combined outflow of $1.27 million.

Analysts view the current situation as consolidation rather than the end of a bull market.

Unlike some investors who fear the end of the bull cycle, Bitfinex analysts consider the current period to be a consolidation phase.

“The current correction is reminiscent of the situations in June 2024 and February 2025, when Bitcoin was at a crossroads between recovery and a deeper decline,” the analysts noted.

According to their estimates, the current decline is in line with the average of previous corrections. Each decline since the start of the bull market in 2023 has reached approximately 22% of the all-time high before the reversal.

Importantly, approximately 72% of BTC supply remained profitable as Bitcoin fell to $100,000. This indicates mid-cycle consolidation, but a recovery will require a new influx of demand from institutional and retail investors.

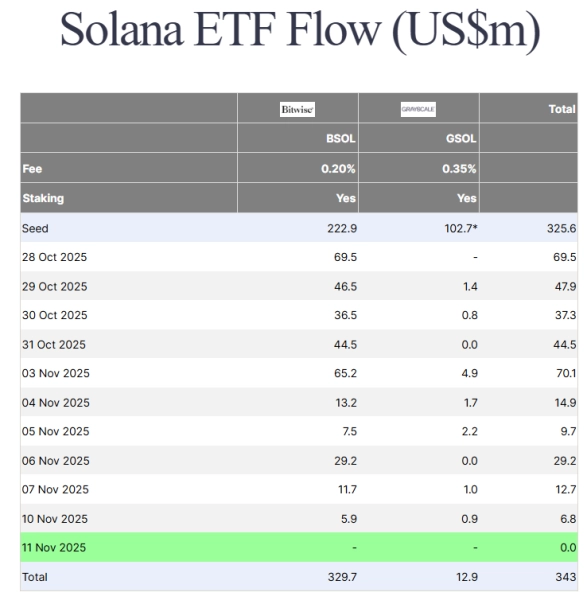

Solana ETF Fund Flows, USD, Millions. Source: Farside Investors

Among other crypto ETFs, the Ethereum ETF also showed no growth on Monday. Meanwhile, the Solana ETF attracted $6.8 million, continuing its 10-day streak of net inflows.

Source: cryptonews.net