Bitcoin demand hits 4-month high: what's next for the price?

Bitcoin (BTC) traders and investors are actively shifting to riskier strategies amid improving macroeconomic conditions.

At the time of writing, “apparent demand” reached its highest level since July 31st. This metric from Capriole Investments estimates demand by measuring the supply from mining minus supply that has been inactive for more than a year.

On November 11, the metric soared to 5,251 BTC. It remained negative since October 8. On October 21, the value bottomed out at around -3,930 BTC. The low was followed by a sharp reversal, as seen in the chart below.

Apparent demand for Bitcoin. Source: Capriole Investments.

Apparent demand for Bitcoin. Source: Capriole Investments.

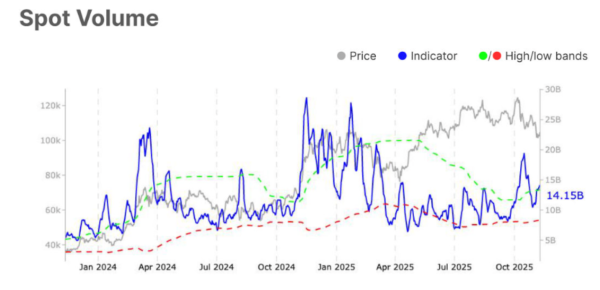

Meanwhile, spot trading volume increased by 23% over the week, from $11.5 billion to $14.1 billion. This dynamic indicates high speculative activity.

This rise suggests that Bitcoin's recent recovery to $106,000 was an “early sign of buyers returning.”

“The increase in spot trading volume indicates more active investor participation and a potential bullish breakout,” Glassnode noted.

Related: Trader James Wynn doubled his short positions after 12 liquidations, expecting Bitcoin to fall below $92,000.

Bitcoin spot trading volume. Source: Glassnode.

Bitcoin spot trading volume. Source: Glassnode.

Bitcoin must reclaim the $110,000 level.

Bitcoin managed to end the week above its 50-week simple moving average, reassuring traders that the rally would continue.

MN Capital founder Michael van de Poppe said Bitcoin is likely to head towards its all-time high of $126,000 if it breaks $110,000.

Analyst Jelle noted that it is crucial to regain support at $110,000, “as a pullback from it would be a clear sign of further weakness in the market.”

On the topic: Glassnode has recorded the first signs of Bitcoin's recovery after the October crash.

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net