The crypto market is down today after the US Federal Reserve Chair Jerome Powell shared more hawkish remarks than expected.

The Fed announced a 25-basis-point rate cut, and it signaled fewer rate reductions in 2025 than projected.

Commenting on Strategic Bitcoin Reserve speculations, Powell said that “we’re not allowed to own Bitcoin.” He added that any potential reserve would require Congressional consideration.

Meanwhile, Binance.US said it plans to restore USD services by early 2025, which would be beneficial for digital assets in the US and, likely, the overall market.

At the time of writing, the global cryptocurrency market capitalization is down 4.7% over the last 24 hours, moving further away from the $4 trillion mark. It now stands at $3.68 trillion.

The daily crypto trading volume is $333 billion, somewhat higher than what we’ve been seeing over the last few days, but lower than the numbers seen at the start of the rally.

Only 5 of the top 100 coins per market cap have seen their prices rise today, while the rest dropped.

All top 10 coins per market cap have seen their price decrease today.

The largest drop is Dogecoin (DOGE)’s 6.9% to $0.35936.

It’s followed by XRP (XRP) and Cardano (ADA): 6.3% each. XRP currently trades at $2.36, and ADA fell below $1, standing at $0.96904.

The rest of the list is down between 2% and 5%.

Bitcoin (BTC) decreased by 2.3%, currently trading at the price of $101,688.

At the same time, Ethereum (ETH) decreased by 5%, changing hands at $3,670.

Meanwhile, Bitcoin and Ethereum spot exchange-traded funds (ETFs) recorded inflows for two straight weeks, reflecting strong investor interest.

On Wednesday, Bitcoin spot ETFs saw a total net inflow of $275 million, and Ethereum spot ETFs reached $2.45 million.

Additionally, Bitcoin mining machines prices surged in Shenzhen, China, following the recent spike in the Bitcoin price.

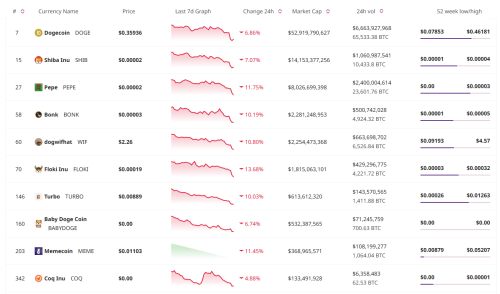

The top 10 meme coins have recorded a significant drop today.

Not only are all of them down, but six saw double-digit drops as well.

The highest among these is Floki Inu (FLOKI)’s 13.7%. The coin currently trades at $0.00019.

Next up are Pepe (PEPE) and Memecoin (MEME), with drops of 11.75% and 11.45% to $0.00002 and $0.01103, respectively.

The rest of the list is down between 4% and 11% per coin.

The category’s first coin per market cap, Dogecoin (DOGE), fell 6.9% to $0.35936, while the second coin, Shiba Inu (SHIB), fell 7.1% to the price of $0.00002.

At the same time, while the 2025 outlook for DOGE looks promising, the coin could see further downside in the coming weeks.

Unsurprisingly, the meme coins, too, slumped following the hawkish policy announcement from the US Federal Reserve.

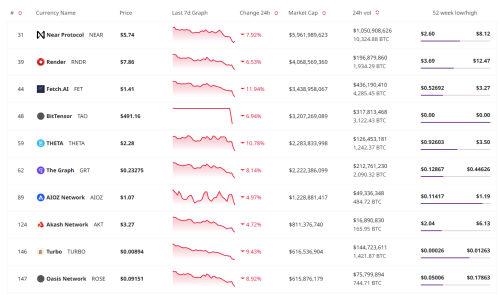

Just like the previous two categories, all top 10 AI coins recorded drops in their prices over the past 24 hours.

Two saw double-digit decreases. Fetch.AI (FET) is down nearly 12% to $1.41, while Theta (THETA) fell 10.8% to $2.28.

These are followed by Turbo (TURBO)’s 9.5% drop to the price of $0.00894.

The rest of this list is down between 4% and 9%.

Near Protocol (NEAR), the top coin in this category, fell just below 8%, now trading at $5.74, while the second-placed Render (RNDR) dropped 6.5% to $7.86.

Meanwhile, last Thursday, the Artificial Superintelligence Alliance (ASI) – involving SingularityNET, Fetch.ai, and Ocean Protocol – unveiled its roadmap. It includes plans and goals for 2025.

Additionally, it republished the ASI CORTEX whitepaper yesterday, which it shared in late November. ASI aims to build advanced foundational models across various areas of AI, with an emphasis on robotics, said the team. “Our initial goal is to develop and train Cortex, a model designed to improve robotic capabilities significantly through cutting-edge AI.”

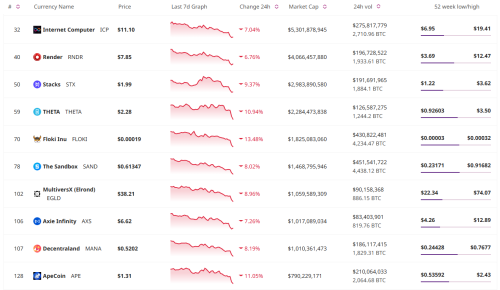

The all-red trend continues with the top ten metaverse coins.

The highest decrease here is 13.5% recorded by Floki Inu (FLOKI), which is currently trading at $0.00019.

ApeCoin (APE) and Theta (THETA) also saw double-digit falls of around 11% each, now changing hands at $1.31 and $2.28, respectively.

At the same time, the smallest drop in this category is Render (RNDR)’s 6.8% to $7.85.

The top coin in this category, Internet Computer (ICP), is down 7%, with its price now standing at $11.1.

Meanwhile, the FLOKI team recently announced that the Valhalla mainnet launch would be delayed until the first quarter of 2025 in line with feedback from the auditors.

This Tuesday, it shared the eligibility checker for the MONKY launch airdrop. It is available to FLOKI and TOKEN holders. Today, the team said that the Wise Money token is live on Binance Alpha, as a part of the new batch of 10 Binance Alpha Projects.

Unlike other categories in this article, one of the top 10 gambling coins has seen its price increase today.

SX Network (SX) appreciated 1.2% to the price of $0.08446.

On the other hand, one coin recorded a double-digit drop. Dotmoovs (MOOV) is down 13.4% to $0.00188.

It’s followed by REKT (REKT), which fell 9.5%, while the rest of this list is down between Edgeware (EDG)’s 0.9% and FUNToken (FUN)’s 8.6%.

Rollbit Coin (RLB), the category’s top coin, decreased 7.7%, now trading at $0.12368.

Dotmoovs recently partnered with Kutsaca, a Mozambique-based organization empowering vulnerable children through sports, creativity, and education. The team is preparing “a special event” is to celebrate this collaboration, they said.

Crypto markets can move on a dime, switching from uptrends to sudden drops without warning. Part of the challenge lies in market size. The industry’s relative youth and smaller market capitalization make it more volatile.

For context, the entire crypto market is currently worth the same as Apple alone. The former’s total market cap is $3.54 trillion, and the latter’s is $3.55 trillion.

There are many reasons why the crypto market may go down.

They range from elements native to the crypto industry, over those typically related to traditional finance, to global events.

Some are long-lasting, while others cause short-term drops. Some may lead straight into a crypto winter.

Here’s a comprehensive list of the key factors that can lead to a decline in the crypto market.

Technology failures: If the underlying technology or code behind a cryptocurrency is proven to be flawed or buggy, it can lead to significant declines in market value.

Investing in cryptocurrency comes with risks. However, key crypto assets, such as BTC and ETH, have far outperformed traditional investments in the past decade. To reduce risk in crypto investments, consider making crypto a limited part of a larger investment portfolio.

To reduce volatility, use dollar-cost averaging (DCA) to purchase a fixed dollar amount at fixed intervals. This strategy buys more of the asset when prices swoon and smaller amounts when prices spike, often reducing average costs in the long run.

These are the largest factors to keep in mind when discussing cryptocurrency market price movements.

Each of the above-listed factors can contribute to a downturn in the crypto market.

Notably, it is often a combination of two or more of these elements that impact the price movements.

Due to the market’s volatile nature, large enough events or changes can trigger sharp price movements.

This creates a potential for both rapid gains and significant losses.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…