An increasing number of credit cards have entered the crypto ecosystem. Typically issued by Visa or MasterCard, they enable users to spend crypto balances in the real world. It’s also possible to earn free crypto when making eligible transactions, similar to traditional credit card rewards.

But what are the best crypto credit cards in 2024? Read on to discover the top providers for fees, limits, rewards, eligibility, and other important metrics. We also explore the different types of credit cards available, how they work, and what best practices to consider.

We’ll now review the leading crypto cards, covering everything consumers need to know. Ensure you read through each review to make an informed decision.

Gemini is a popular US-based exchange with heavy regulation and robust security features. It also offers one of the best crypto credit cards, especially for those seeking competitive rewards. The Gemini credit card offers 4% cashback at US gas and EV charging stations. It also offers 3% and 2% on dining and groceries, respectively.

All other transactions get 1%. This means you’ll earn rewards whenever the card is used, no matter what you’re buying. Not only are rewards deposited in your Gemini account instantly but you can choose from over 50 cryptocurrencies. This includes Bitcoin and some of the best altcoins, such as Ethereum,

The Gemini credit card is issued by MasterCard, so can easily be used online and in-store. Best of all, the card comes without annual or foreign exchange fees. Standard APYs on this crypto card are 17.74% – 29.74%, depending on your creditworthiness. The APY on cash advances is 30.74% for cardholders.

How to Earn With Gemini Credit Card?

Cardholders can choose from over 50 cryptocurrencies for their rewards.

Crypto.com offers six different crypto credit cards. Each is issued by Visa, ensuring the card can be used at millions of online and in-store merchants. All cards apart from ‘Midnight Blue’ offer rewards. This ranges from from 2% to 8% on everyday transactions. Travel-related spending offers rewards of up to 10%.

Those on the higher-tier cards also get free Spotify and Netflix subscriptions. Not to mention airport lounge access and exclusive sporting experiences (including F1 and UEFA Champions League). However, there are some drawbacks to consider before applying for the Crypto.com credit card.

First, rewards are only paid in Cronos (CRO), Crypto.com’s native token. What’s more, rewards are only paid when users hold a minimum amount of CRO. For example, the ‘Prime’ card requires at least $1 million worth. The lowest amount of CRO to hold is $500 on the ‘Ruby Steel’ card. However, this only offers 2% rewards and no bonuses on travel-related spending.

How to Earn With Crypto.com Visa Card?

Cardholders can only receive rewards in CRO. Plus, a minimum amount of CRO is needed to be eligible for rewards.

Bybit – one of the best crypto exchanges globally, also offers a popular card. Backed by MasterCard, first-time applicants can earn a 20 USDT introductory bonus. The only requirement is to spend 150 USDT in transactions. The Bybit card comes without application or annual fees. It offers cashback rewards of between 2-10% on everyday purchases.

However, the specific rate depends on the Bybit VIP tier. This is determined by trading volumes on the Bybit exchange. As such, this is only a good option for active Bybit users. Nonetheless, Bybit offers a physical and virtual card for added convenience. Bybit also offers subscription rebates for popular online platforms.

This includes Amazon Prime, Spotify, Netflix, TradingView, and ChatGPT. These perks require a VIP tier of at least 1. Crucially, do note that Bybit offers a debit card rather than a credit card. This means you can only spend balances held in the Bybit account. Moreover, you won’t need to worry about interest payments.

How to Earn With Bybit Card?

Rewards can be redeemed in the Rewards Market (for perks) or for USDT.

The next option to consider is the Coinbase Case. Backed by one of the world’s largest exchanges, Coinbase Card is issued by Visa. It’s only available to US residents and functions as a debit card. This means there’s no credit check when applying, nor will cardholders pay interest.

There are no spending or annual fees either. Coinbase Card is a great option for earning rewards. It offers 1% on all transactions when receiving rewards in Bitcoin, Ethereum, and Dogecoin. This increases to 4% when opting for Stellar or The Graph. Coinbase Card is also one of the most secure options.

It comes with two-factor authentication and card freezing. The latter is crucial if you misplace the card, especially when overseas. Cardholders benefit from 24/7 customer support via telephone and email. Coinbase Card also comes with a dedicated app, making it seamless to track and manage transactions.

How to Earn With Coinbase Card?

The earning percentage depends on the reward currency. Bitcoin, Ethereum, and Dogecoin pay 1%. Stellar or The Graph pay 4%.

Nexo offers a wide range of services, including savings accounts, loans, and a crypto card. The card is issued by MasterCard and it comes with a native app for iOS and Android. The app offers real-time transaction notifications and the ability to freeze the card at any time. That said, the most interesting feature is being able to switch between ‘credit’ and ‘debit’ modes.

The latter enables users to spend their crypto balances, with transactions converted to the local currency. Alternatively, users can pay for purchases with a credit line, with borrowing rates starting at 2.9%. This is a good option for those who don’t want to sell their cryptocurrencies to pay for transactions.

That said, credit lines are based on account balances, meaning the value of your crypto is used as collateral. Nevertheless, the Nexo Card offers cashback rewards, although they’re much lower than other providers. You’ll earn between 0.1% and 0.5% in Bitcoin. And between 0.5% and 2% in NEXO, the platform’s native token. The specific amount depends on the account tier.

How to Earn With Nexo Card?

The earning percentage depends on the account tier and all spending categories are included.

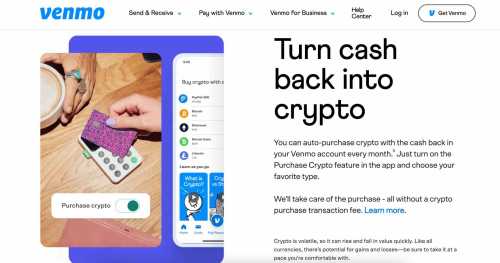

Venmo is a popular credit card for US residents. It’s issued by Visa and seamlessly connects with Google, Apple, and Samsung Pay. The Venmo credit card not only offers unlimited cashback rewards. But users can choose their preferred spending category. Popular options include dining, groceries, travel, bills, and entertainment.

Now, you’ll get 3% cashback on every purchase in the top spending category, and 2% on the next. All other transactions get 1%. You can change the category preferences every month. Crucially, you can automatically use cashback rewards to buy cryptocurrencies. This is a great way of dollar-cost averaging, as you’re not risking any money.

Rewards can be paid in the best cryptocurrencies, including Bitcoin, Litecoin, Bitcoin Cash, and Ethereum. In terms of interest rates, Venmo offers APRs of 19.99%, 28.99% or 31.99%. The rate offered depends on your creditworthiness. There are no application, annual, or foreign transaction fees.

How to Earn With Venmo Credit Card?

Once activated, the monthly cashback payouts can be used to buy cryptocurrencies. Options include Bitcoin, Litecoin, Bitcoin Cash, and Ethereum.

Last on this list is the Gnosis Pay Card. It’s a crypto debit card issued by Visa. Do note the Gnosis Pay Card is only available to clients in the European Union and the UK. The card costs €30.23 (including shipping), which will be a drawback for some. That said, the Gnosis Pay Card doesn’t charge annual fees.

Nor does it charge for transactions or foreign exchange. In terms of rewards, the Gnosis Pay Card offers cashback of up to 5%. However, rewards are paid in GNO, the card’s native token. While this will disappoint those wanting to earn Bitcoin and other top coins, GNO is up 40% in the past month.

What’s more, the circulating and maximum supply are just 2.59 million and 3 million, respectively. This makes GNO one of the best low-supply cryptocurrencies. Another benefit is that the Gnosis Pay Card can be customized with an Ethereum Name Service (ENS) domain. Early adopters can also get an OG NFT, although further details will be released on X in due course.

How to Earn With Gnosis Pay Card?

Cashback rewards are paid in GNO, the card’s native token.

Crypto credit cards function like traditional cards issued by Visa and MasterCard. They enable users to spend funds online and in-store. ATM withdrawals are often supported too.

There are different types of crypto cards in the market:

Ultimately, the best crypto credit cards allow users to spend their digital assets while earning rewards on transactions.

Crypto cards work differently depending on the provider.

First, some providers offer crypto debit cards, meaning you aren’t borrowing funds. This also means you won’t need to undergo a credit check or pay interest on outstanding balances. Instead, you can only spend what’s available.

Alternatively, some providers offer crypto credit cards. This means you’ll receive a credit limit and an APY, depending on your creditworthiness.

Now, some crypto cards are connected to the user’s exchange or wallet balances.

Here’s how it works:

In addition, you can also earn rewards when using a crypto card.

Here’s how it works:

Our methodology covered the most important factors when ranking crypto cards.

This includes the following:

Here are the most common crypto credit card rewards available in 2024:

Crypto credit cards are worth exploring if you want increased exposure to digital assets. You can often spend crypto balances in the real-world, with cards usually issued by Visa or MasterCard.

You can earn free crypto too, with many cards coming with cashback rewards. Choosing the right card requires careful consideration, such as fees, reward rates, and limits. You also need to decide between a debit or credit card.

One of the best crypto credit cards is offered by Gemini. It offers cashback of up to 4% and rewards can be paid in over 50 cryptocurrencies.

Crypto.com and Bybit offer cashback rewards of up to 10%, but this depends on the card tier. Alternatively, consider Gemini, which offers 4% cashback on gas and EV charging purchases.

Coinbase is the best Bitcoin rewards credit card for security, although cashback is only 1%. Venmo Credit Card is also worth considering, it offers 3% in the holder’s preferred spending category.

Some of the best crypto cards for Ethereum rewards include Gemini, Coinbase, and Venmo. Each varies in spending categories, limits, and eligibility – so independent research is needed.

Some cards allow users to spend their balances from exchange and wallet holdings. Others function as traditional credit cards, where limits depend on your credit score.

The required credit score depends on the card provider. Those with bad credit might consider a crypto debit card, which doesn’t come with credit checks.

Yes, the most popular is the Gemini Credit Card. Issued by MasterCard, it offers cashback rewards on all spending categories.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…