Binance is the world’s largest cryptocurrency exchange, with a separate exchange (Binance.us) serving the US market. Binance’s missive market means higher liquidity and more efficient trades, but is Binance safe to use?

Many experienced traders remove their crypto from exchanges after they’re done trading. This measure helps safeguard against hacks, frozen accounts, and other risks. However, safety sometimes takes a backseat to convenience, and trade timing may interfere with your plans for a speedy withdrawal.

Adding to the concern, Binance’s founder and former CEO pled guilty to charges related to anti-money laundering (AML) compliance on the exchange. Despite this, Binance’s trading volume still dwarfs that of competing exchanges. In this guide, we’ll examine Binance’s safety features to answer the question, “How safe is Binance exchange?” Let’s start with the pros and cons of using the Binance platform for trading.

Binance has several advantages, including a large selection of popular cryptocurrencies, many of which aren’t available on Coinbase or Kraken. The platform is also well-known for its advanced trading tools. Safety features range from proof of reserves to whitelisting and even insurance funds.

Pros

Cons

However, a spotty history of breaches and ongoing regulatory concerns give reason to investigate further. Let’s examine some of Binance’s safety features and how they work to protect users.

How safe is Binance exchange? Since its launch in July 2017, Binance has introduced several key safety features, including an innovative self-insurance fund bearing the fun acronym SAFU. Let’s explore some of the safety and security measures Binance has put in place to protect users.

One year after launching the Binance exchange, Binance launched the Secure Asset Fund for Users (SAFU). This emergency fund is intended to protect users against losses from a variety of potential causes. However, Binance specifically names login credential breaches due to a vulnerability or deficiency on Binance’s part as a key coverage target for the fund. Binance also reserves the right to change the use of the fund as needed.

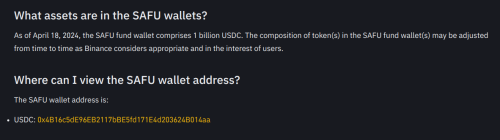

Funding comes from a percentage of trading fee income set aside. Over the years, Binance has changed the fund’s makeup, shuffling token allocations. As of this writing, SAFU holds more than $1 billion in assets, currently stored in the USDC token, which is pegged to the USD value.

Binance publicizes the Ethereum wallet address of SAFU holdings for transparency.

0x4B16c5dE96EB2117bBE5fd171E4d203624B014aa

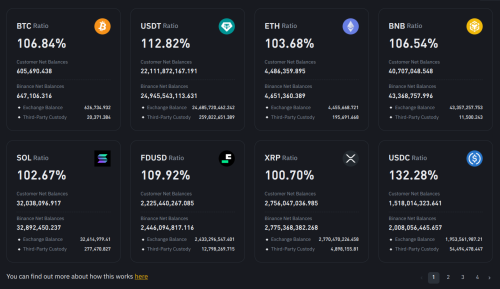

Binance was among several competing exchanges that led the way on proof of reserves (PoR), an audited method of showing an exchange has sufficient assets to cover user deposits. Proof of reserves shows Binance’s on-chain holdings relative to customer balances.

In many cases, Binance’s reserves well exceed those needed to cover customer balances.

Proof of reserves is an essential step toward transparency. CoinMarketCap, a leading crypto data aggregator, tracks more than 250 spot-market crypto exchanges. However, dozens of exchanges close or disappear each year. Among the most noteworthy have been Mt. Gox and the FTX exchange, the latter of which collapsed in 2022 amid scandal.

As the largest crypto exchange by trading volume, Binance represents a considerable risk to the crypto without proof or reserves. PoR provides verifiable assurance that funds are indeed SAFU, a term adopted by the community to indicate safety.

Binance’s PoR is searchable by asset type, with the block height provided for each asset. This allows quick verification using a block explorer to view holdings by wallet address.

Although Binance offers crypto trading, the platform itself is still web 2.0, meaning you log in with a username and password. Login credentials are the keys to the kingdom. If someone gains access to your trading account, they can withdraw your funds or, in some cases, access your funding accounts, such as a bank account.

In the US alone, the number of data breaches topped 3,200 in 2023. Many of these breaches centered on login credentials and other account information.

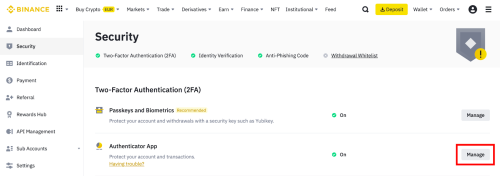

Binance offers two-factor authentication, enabling users to secure their account with a separate device they control. This prevents remote access if your login credentials are compromised.

Supported 2FA authentication methods include a security key, such as Yubikey, or an authenticator app, such as Google Authenticator. Binance also offers its own authenticator app.

Like most exchanges, Binance stores most of its assets in cold storage. A cold wallet refers to a crypto wallet that generates and stores the wallet’s private key offline. In short, a cold wallet is protected from online threats.

Binance publishes its cold wallet addresses for major coins such as BTC, ETH, and leading stablecoins, allowing users to verify funds independently.

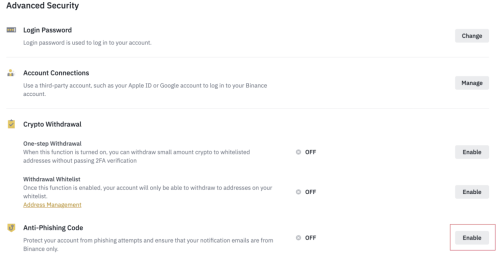

Whitelisting on Binance refers to defining pre-approved wallet addresses. When you enable whitelisting, you choose which addresses are authorized for withdrawals. If someone gains access to your Binance account and tries to withdraw funds to an unauthorized address, Binance blocks the withdrawal and sends an email with an authorization code you can use if you initiated the transaction.

You can also whitelist specific IP addresses. Binance will deny access from any IP address not specified in your whitelist.

Binance monitors account activity for suspicious transactions, including deposits and withdrawals, to make the platform safer for users. The exchange now also strictly enforces Know Your Customer (KYC) and anti-money laundering (AML) policies. While these measures assist in compliance, they also help promote a safer trading environment.

Binance itself is also monitored. Binance’s run-ins with the US Department of Justice brought jitters to the crypto market, but at least one positive result of the kerfuffle was improved oversight. Two firms, one selected by FinCEN and the other chosen by the DOJ, now oversee Binance’s compliance efforts, reporting back to the US government.

The monitoring arrangement, part of a settlement agreement with the US Treasury Department and DOJ, is expected to last three years.

As expected, Binance uses end-to-end encryption to secure connections to the site. In addition, both Binance.com and Binance.us encrypt stored user data.

Phishing refers to spoofing emails to gain information or login credentials. For example, a scammer might send an email that appears to be from Binance asking you to log into your account. Once the scammer has your login information, they can access your account — unless you’ve enabled 2FA authentication.

To combat this risk, Binance lets you enable anti-phishing codes alongside several other security features.

Once you activate an anti-phishing code, Binance includes the code in all official emails from the platform. Emails that don’t include this code or that include an incorrect code aren’t genuine. Anti-phishing codes prevent hasty mistakes and remove the need for time-consuming detective work to determine if an email is genuine.

Every crypto exchange is a target for hackers and exploits, and as the world’s largest crypto exchange, Binance is an attractive target. Several breaches and hacks have occurred over the years. Let’s review some security issues Binance has faced and how the exchange reacted to protect against future attacks.

Binance users have suffered losses in other breaches. However, many of these involved individual accounts and may have been related to malware installed on the user’s machines. In one example, a user reportedly suffered an account breach that led to a $1 million loss. Binance officials denied responsibility for the hacked account, citing a malicious browser extension installed on the user’s device.

Binance already leads the industry in many safety areas. However, there is always room for improvement to make users safer.

Binance offers extensive educational materials on everything from trading to account safety. Users would benefit if Binance made these resources conspicuous in well-trafficked areas of the platform rather than in separate areas like Binance Academy alone. Many users may not be aware of some of the safety features offered by Binance or the risks associated with not enabling safety features.

Binance requires 2FA in many cases, but it is possible to transact without using an authenticator app. In some cases, users can use SMS authentication, which can be exploited remotely with port-out scams. Authenticator apps offer better protection.

Funds not kept on the platform aren’t at risk from platform breaches. Binance could encourage users to withdraw the majority of their funds when not needed for trades. Self-custody crypto wallets allow users to avoid the risks associated with custodial wallets like those used on Binance.

Banks, credit reporting agencies, and even browsers now inform users of breached credentials. To enhance safety, Binance could notify users if the login credentials they’ve used have been compromised. In many cases, users reuse the same login credentials for multiple sites. A breach on another site could put their other accounts at risk.

Binance’s impressive safety measures, combined with crypto best practices, make it a relatively safe exchange to use. Several other exchanges and brokerages also enjoy a good reputation for security.

Coinbase and Kraken provide safe alternatives for users in the US. Binance.com does not support the US, and Binance.us does not support cash deposits (crypto only). eToro recently limited its crypto trading options in the US to three cryptocurrencies, following a settlement with the US Securities and Exchange Commission (SEC).

While exchanges have a duty to protect users where possible, security starts with the user. Some simple steps can help protect your trading account and any linked accounts. Let’s review some of the best practices that can help keep your account safe on Binance or elsewhere.

So, is the Binance exchange safe to use? Binance offers a wide array of safety features to improve your security when using the platform. However, many of these features still require user selection and activation. Not using available features like crypto wallet whitelisting, authenticator app 2FA, and anti-phishing codes makes your account more vulnerable. Additionally, whether using Binance or any other exchange, it’s always wisest to withdraw your funds after you’ve completed your trade.

Binance offers a wide range of safety features that users can enable to help secure their accounts. The exchange also offers proof of reserves, which allows users to verify that the exchange holds enough crypto to cover customer accounts.

Binance stores the majority of crypto assets in cold storage. A cold storage wallet generates and stores the wallet’s private keys offline, protecting against online threats.

Yes, in 2019, more than $40 million worth of Bitcoin was stolen from Binance. The exchange boosted security and covered the loss with its self-insurance fund, called the Secure Asset Fund for Users (SAFU).

Binance.com is not available to US users. However, traders in the US can use Binance.us, although the selection of cryptocurrencies varies between the two platforms.

Binance.us uses Form 1099-MISC to report earnings to the IRS. Binance.com does not serve US customers.

Both platforms now focus on safety and offer many of the same security options. Coinbase may be a better choice in certain regions, such as the US and Canada.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…